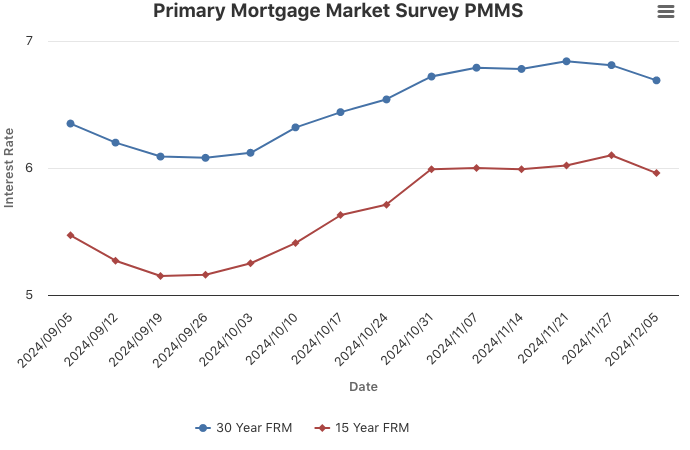

December 5, 2024

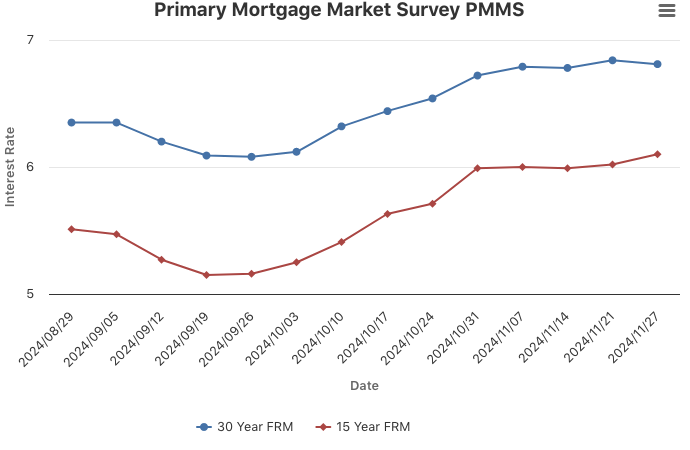

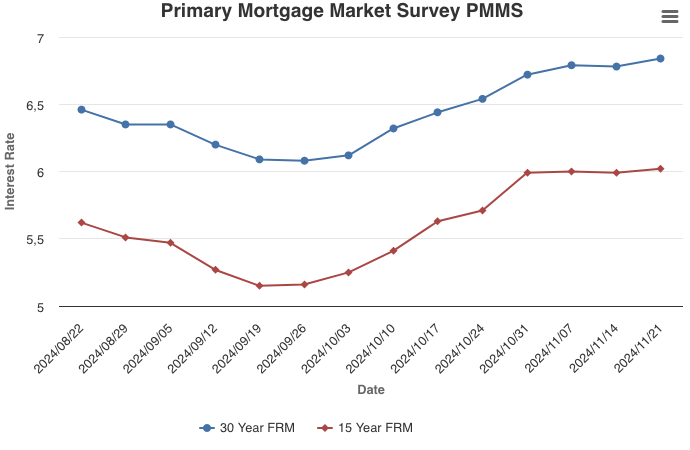

This week, mortgage rates decreased to their lowest level in over a month. Despite just a modest drop in rates, consumers clearly have responded as purchase demand has noticeably improved. The responsiveness of prospective homebuyers to even small changes in rates illustrates that affordability headwinds persist.

Information provided by Freddie Mac.

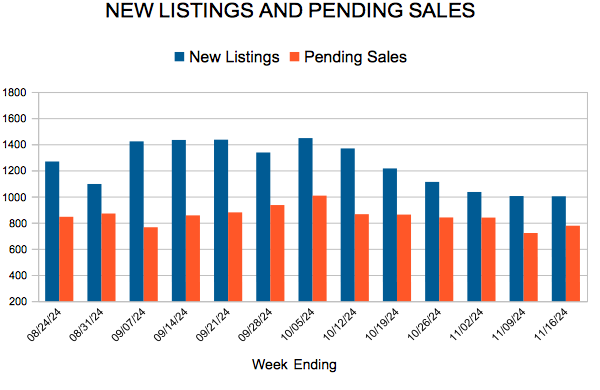

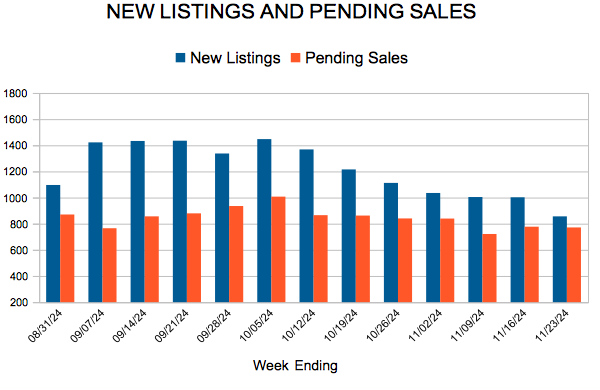

For Week Ending November 23, 2024

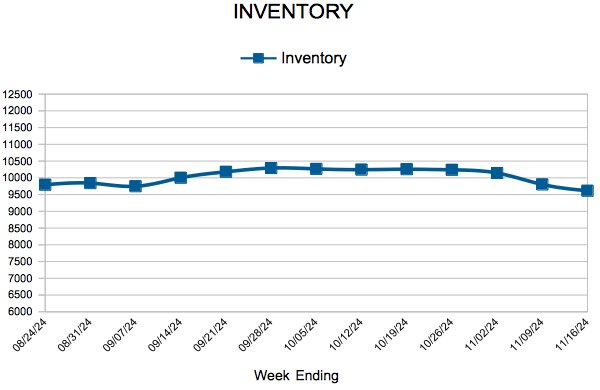

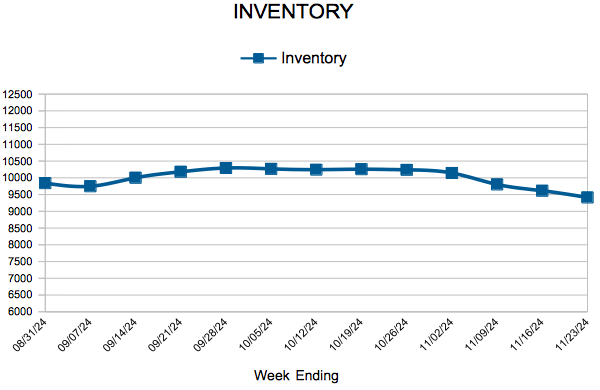

For Week Ending November 23, 2024