February 29, 2024

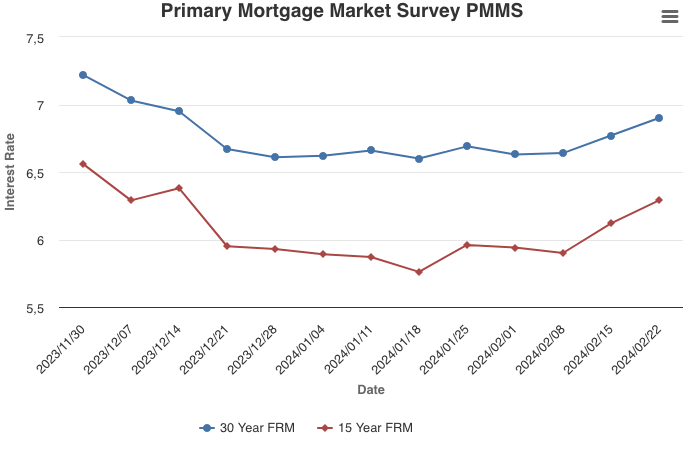

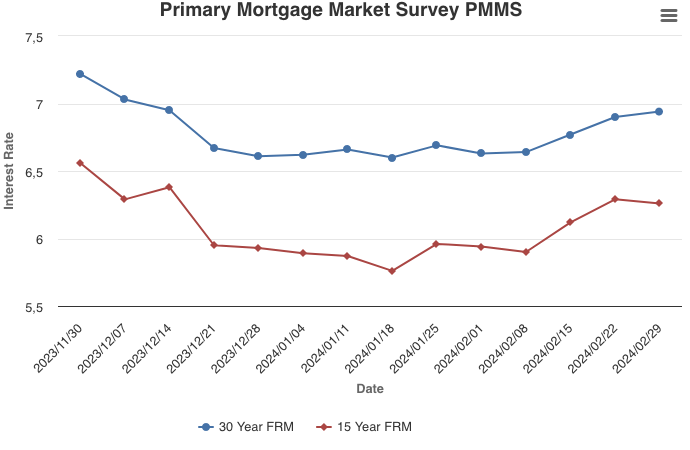

Mortgage rates continued their ascent this week, reaching a two-month high and flirting with seven percent yet again. The recent boomerang in rates has dampened already tentative homebuyer momentum approaching the spring, a historically busy season for homebuying. While sales of newly built homes are trending in a positive direction, higher rates and elevated prices continue to pose affordability challenges that may leave potential homebuyers on the sidelines.

Information provided by Freddie Mac.

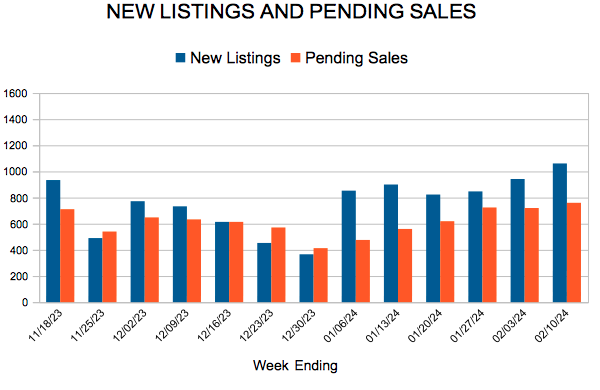

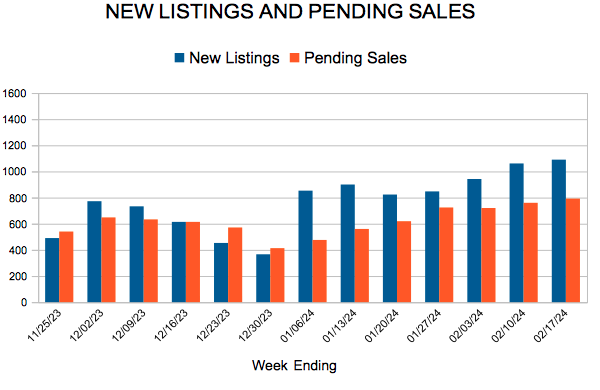

For Week Ending February 17, 2024

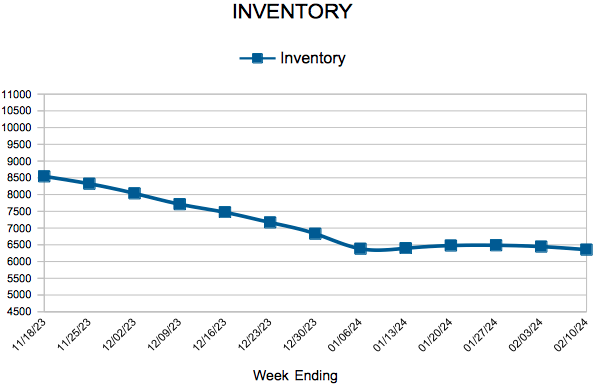

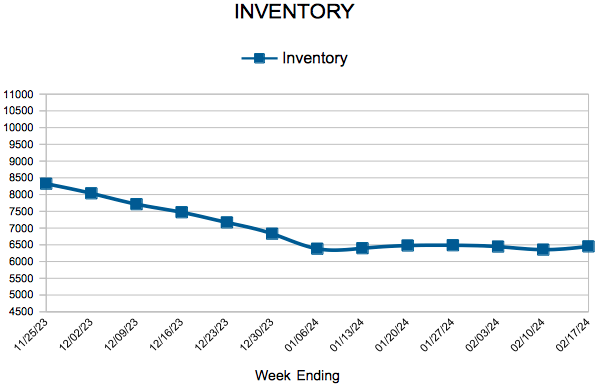

For Week Ending February 17, 2024