June 30, 2022

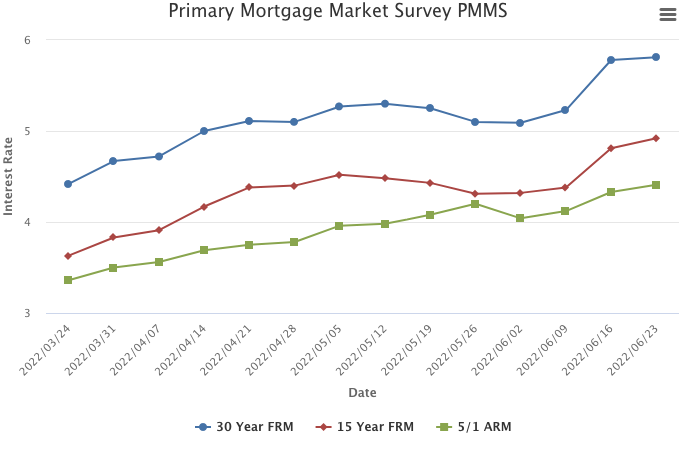

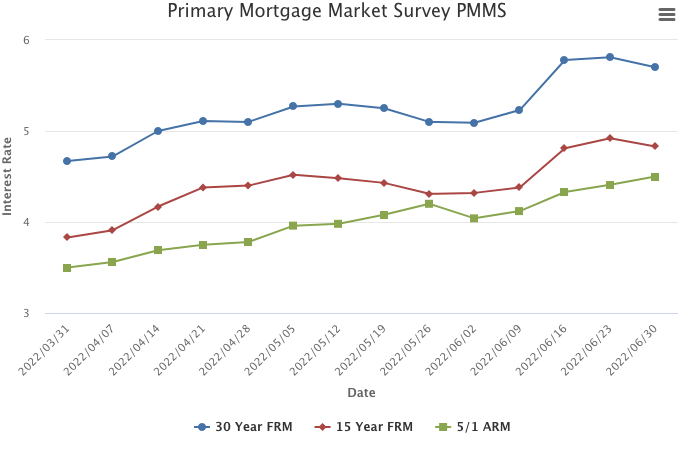

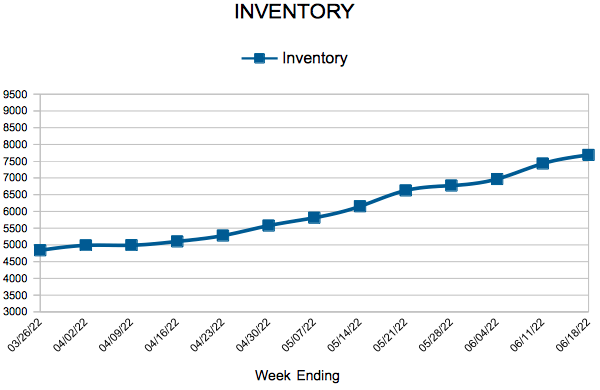

The rapid rise in mortgage rates has finally paused, largely due to the countervailing forces of high inflation and the increasing possibility of an economic recession. This pause in rate activity should help the housing market rebalance from the breakneck growth of a seller’s market to a more normal pace of home price appreciation.

Information provided by Freddie Mac.

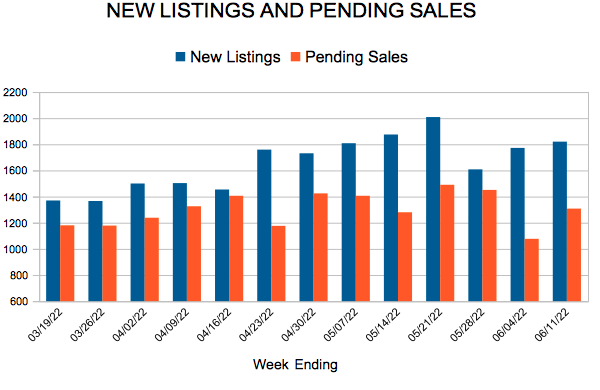

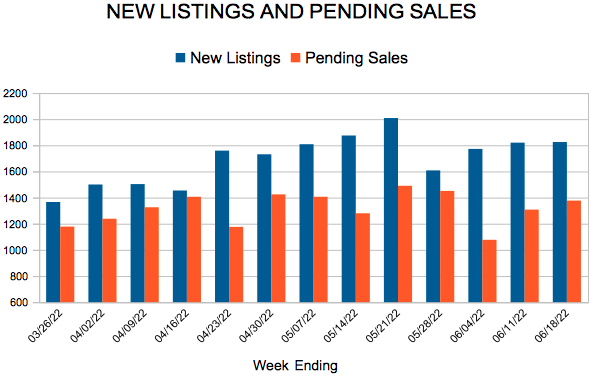

For Week Ending June 18, 2022

For Week Ending June 18, 2022