March 28, 2024

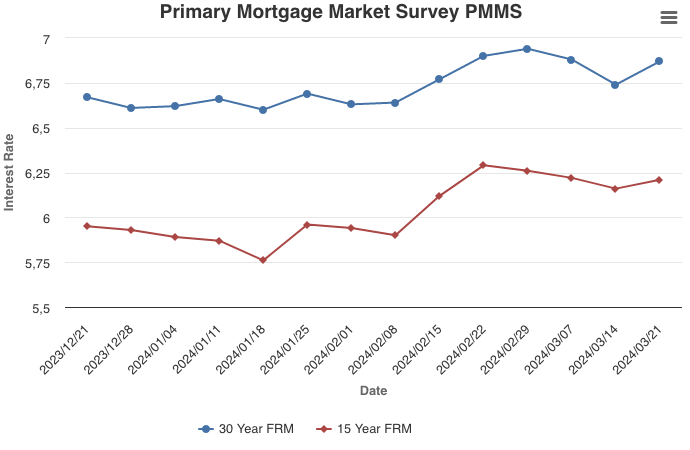

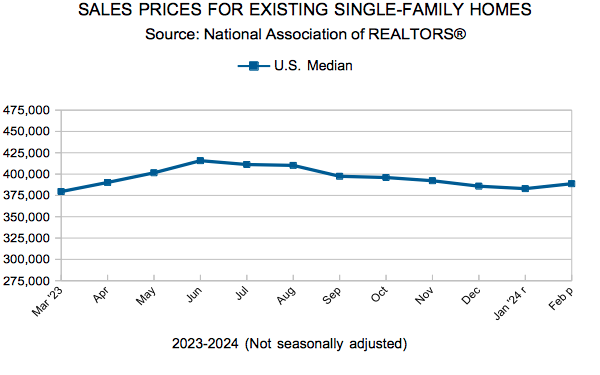

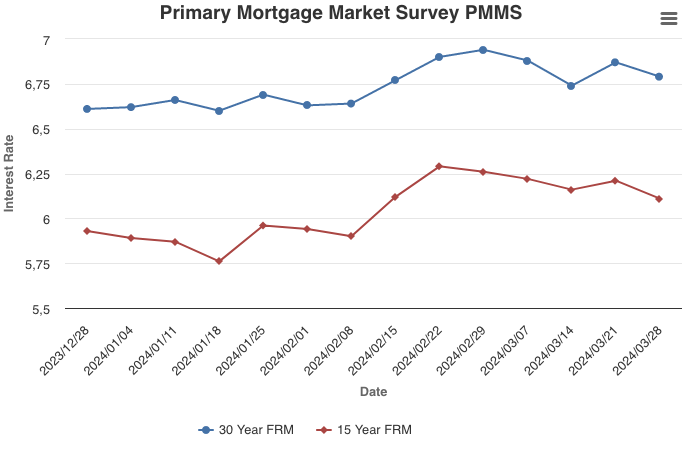

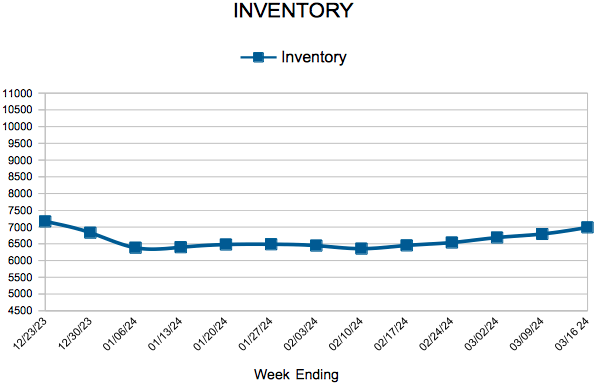

Mortgage rates moved slightly lower this week, providing a bit more room in the budgets of some prospective homebuyers. Additionally, encouraging data out on existing home sales reflects improving inventory. Regardless, rates remain elevated near seven percent as markets watch for signs of cooling inflation, hoping that rates will come down further.

Information provided by Freddie Mac.

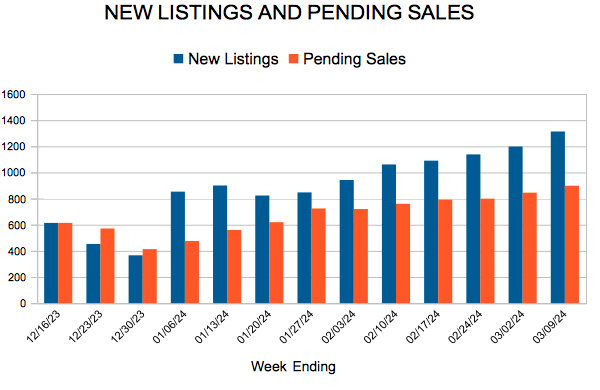

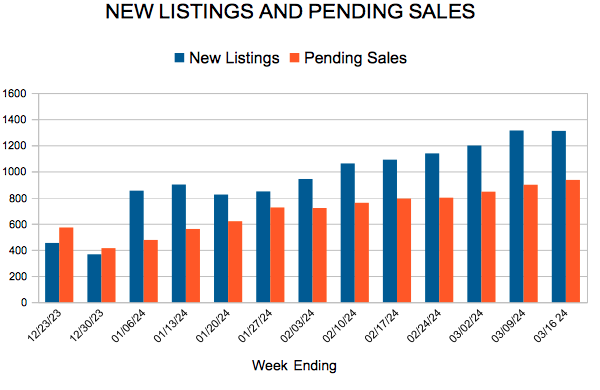

For Week Ending March 16, 2024

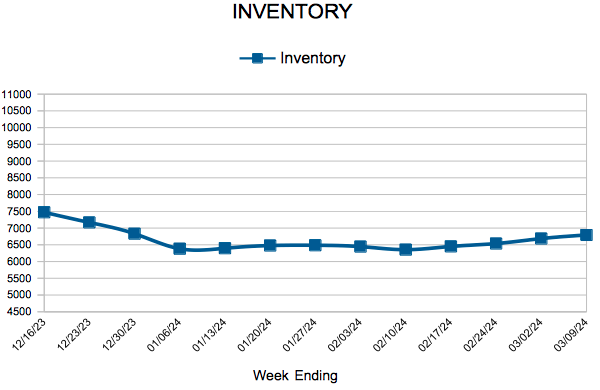

For Week Ending March 16, 2024