July 20, 2023

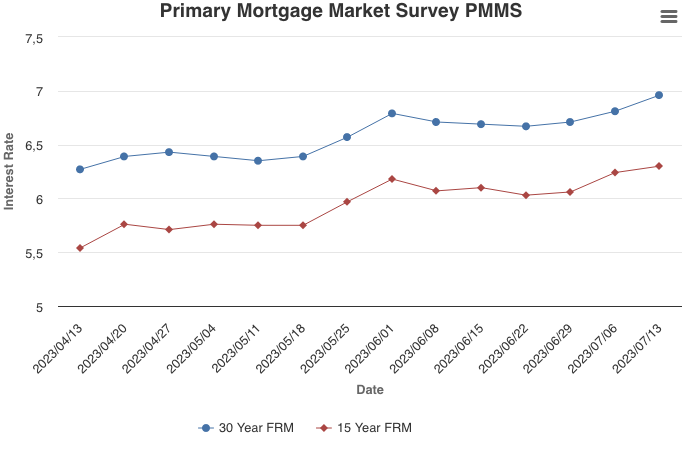

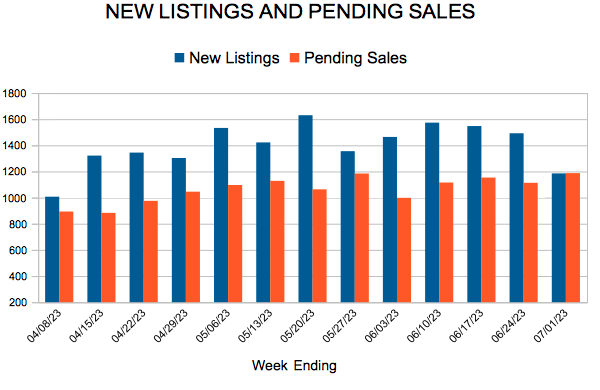

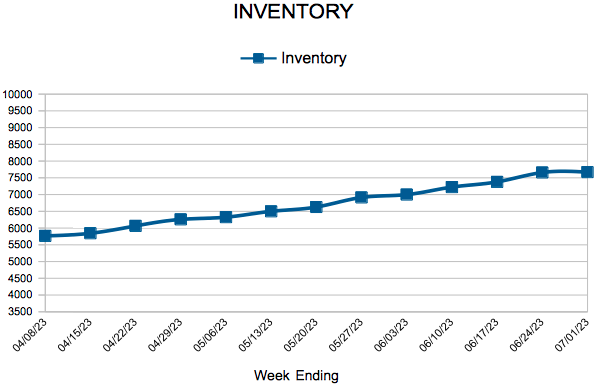

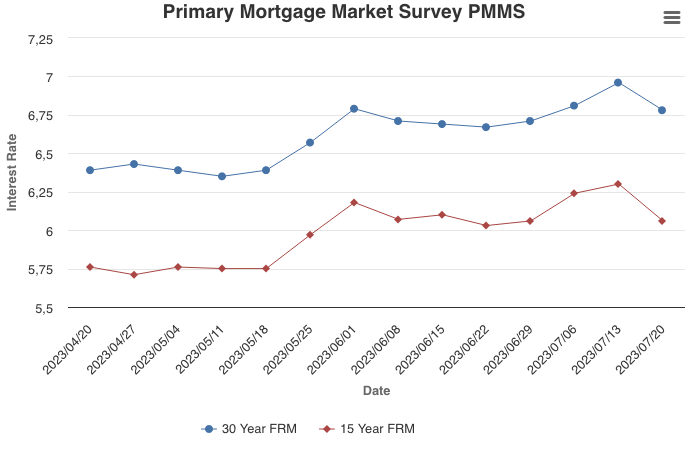

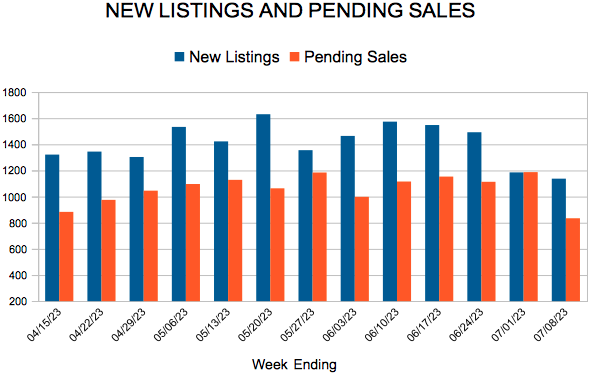

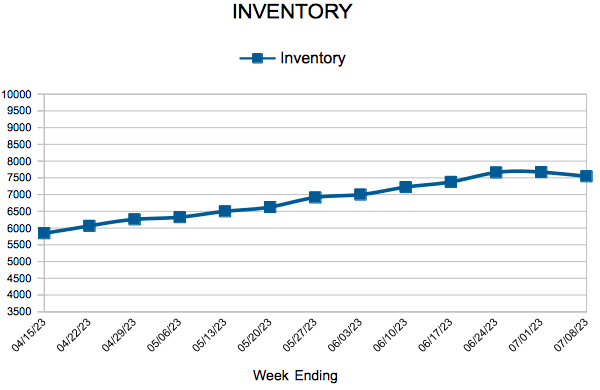

As inflation slows, mortgage rates decreased this week. Still, the ongoing shortage of previously owned homes for sale has been a detriment to homebuyers looking to take advantage of declining rates. On the other hand, homebuilders have an edge in today’s market, and incoming data shows that homebuilder sentiment continues to rise.

Information provided by Freddie Mac.

For Week Ending July 8, 2023

For Week Ending July 8, 2023