For Week Ending July 23, 2022

For Week Ending July 23, 2022

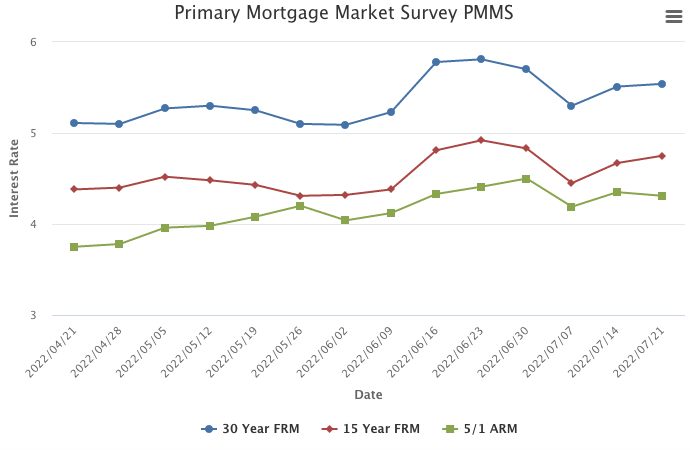

Mortgage applications declined for the fourth straight week, falling 1.8 percent from the previous week and marking the lowest level of activity since February 2000, according to the Mortgage Bankers Association. Increasing mortgage rates, escalating sales prices, and decades-high inflation continue to hinder affordability, putting homeownership on hold for many prospective buyers.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 23:

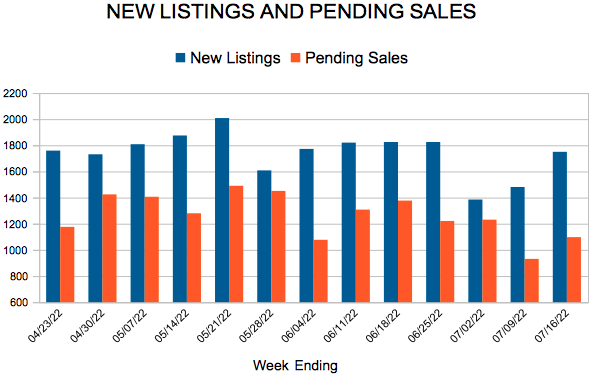

- New Listings decreased 13.5% to 1,607

- Pending Sales decreased 25.1% to 1,142

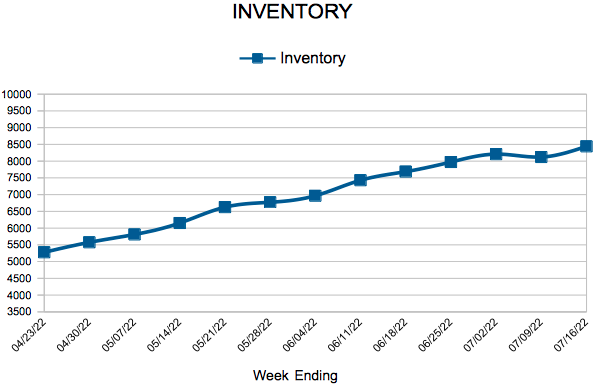

- Inventory increased 9.7% to 8,729

FOR THE MONTH OF JUNE:

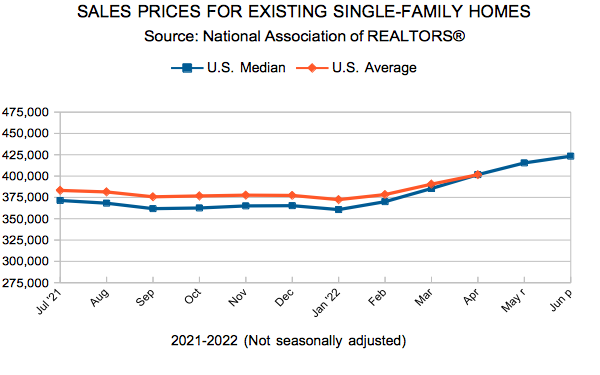

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.