For Week Ending October 21, 2023

For Week Ending October 21, 2023

Annual U.S. single-family rent growth fell to 2.9% in August, marking the 16th consecutive month of declines, according to Corelogic’s most recent Single-Family Rent Index (SFRI). Although rent growth continues to moderate, single-family rents have increased by 30% nationwide since February 2020 and renters are feeling the effects, with the average American renter household spending about 40% of its income on housing costs as of last measure.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 21:

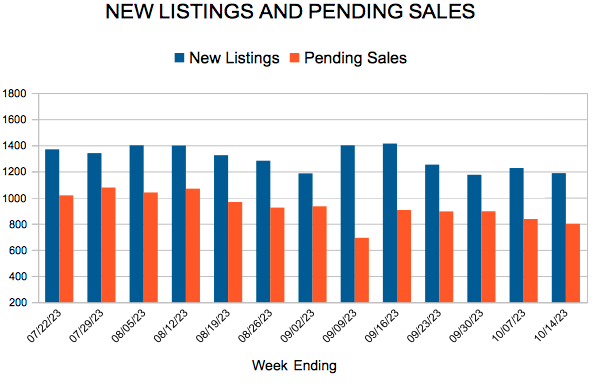

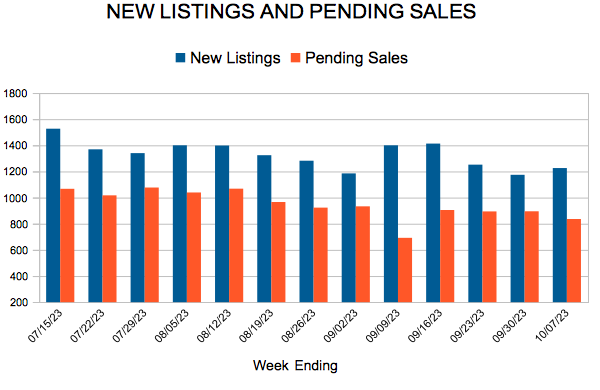

- New Listings increased 3.2% to 1,160

- Pending Sales decreased 10.8% to 762

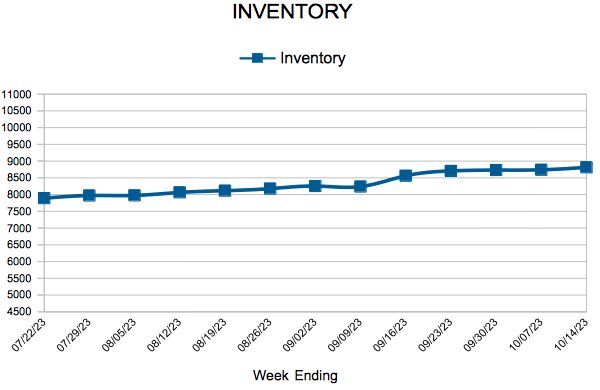

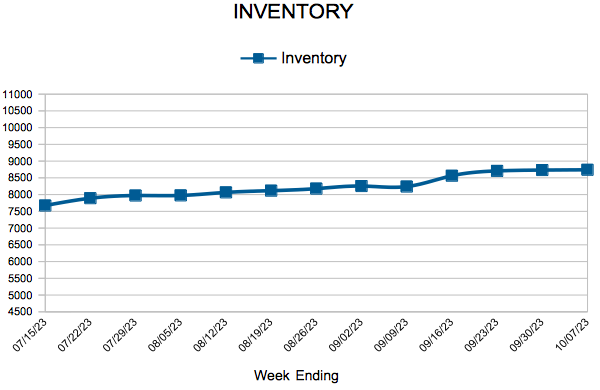

- Inventory decreased 7.5% to 8,839

FOR THE MONTH OF SEPTEMBER:

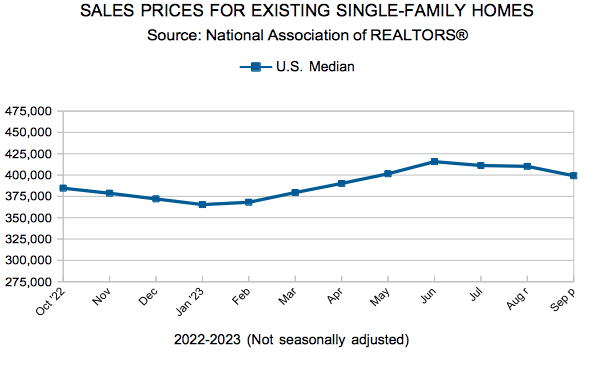

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.