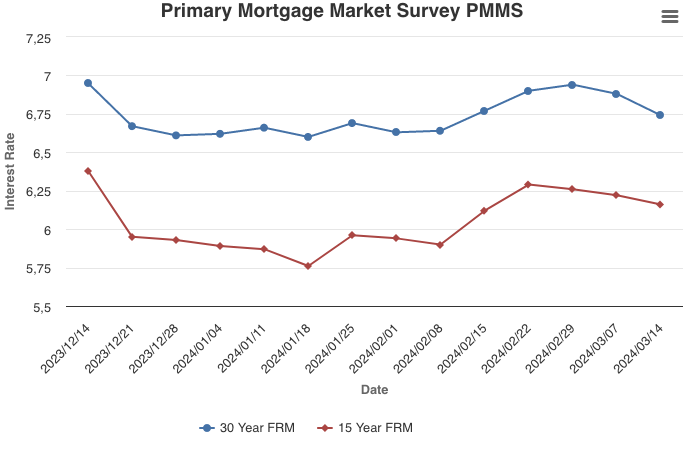

March 14, 2024

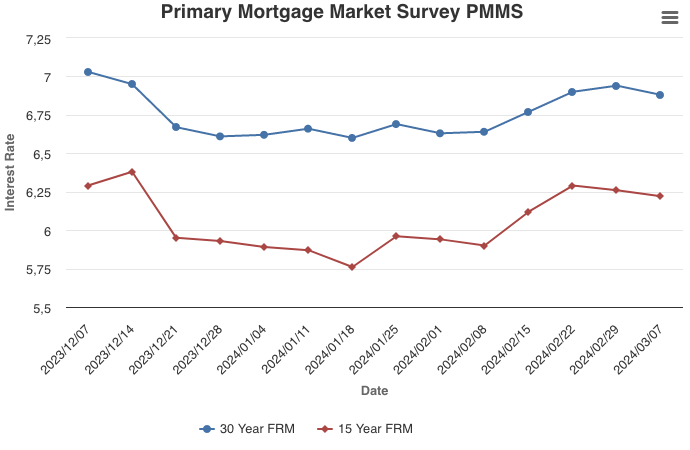

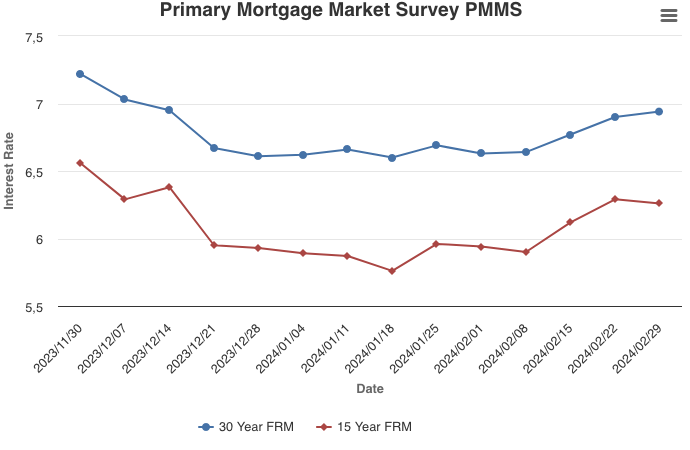

The 30-year fixed-rate mortgage decreased again this week, with declines totaling almost a quarter of a percent in two weeks’ time. Despite the recent dip, mortgage rates remain high as the market contends with the pressure of sticky inflation. In this environment, there is a good possibility that rates will stay higher for a longer period of time.

Information provided by Freddie Mac.

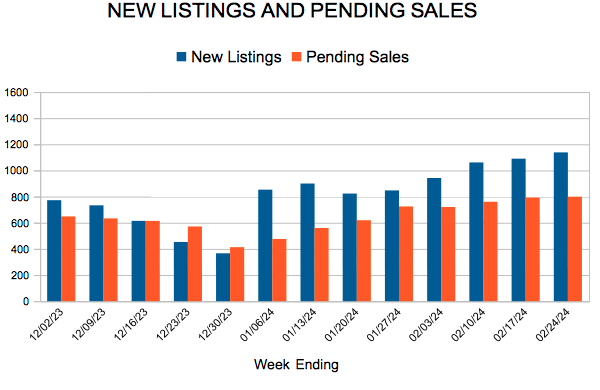

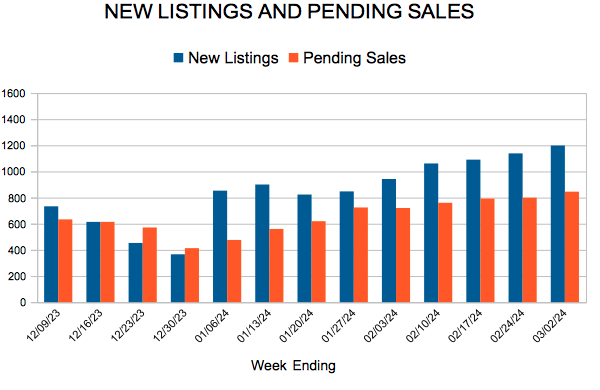

For Week Ending March 2, 2024

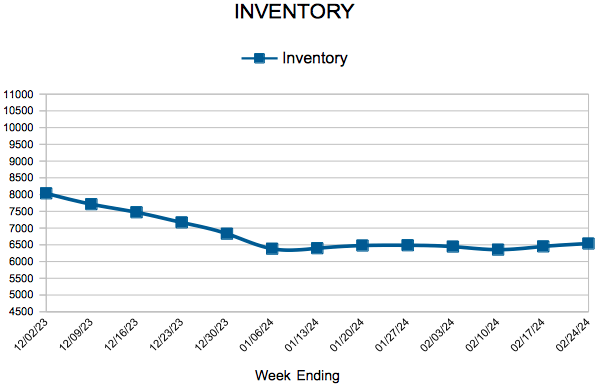

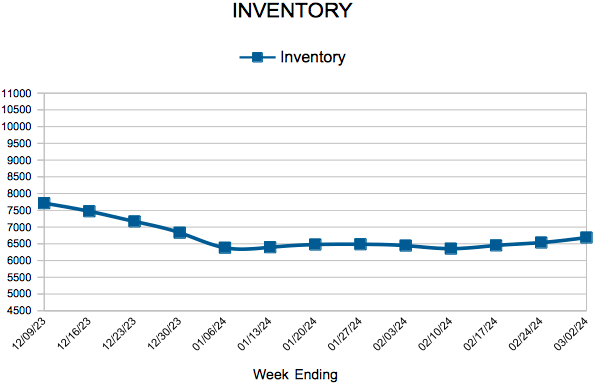

For Week Ending March 2, 2024