For Week Ending July 2, 2022

For Week Ending July 2, 2022

According to the U.S. Census Bureau, Baby Boomers own 32 million homes, accounting for more than 40% of homes owned nationwide. As the second largest population group continues to age and transitions to other housing options, the Mortgage Bankers Association predicts more than 4 million existing homes will hit the market annually over the next decade, boosting supply and helping to meet the growing homeownership demand of younger generations.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 2:

- New Listings decreased 3.1% to 1,385

- Pending Sales decreased 26.0% to 1,231

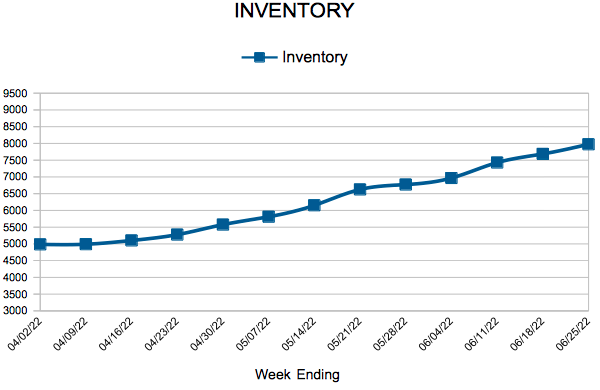

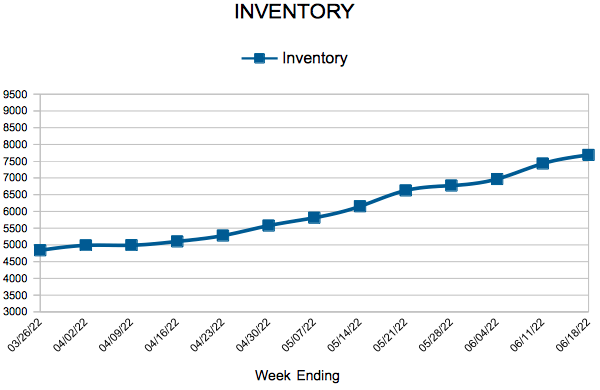

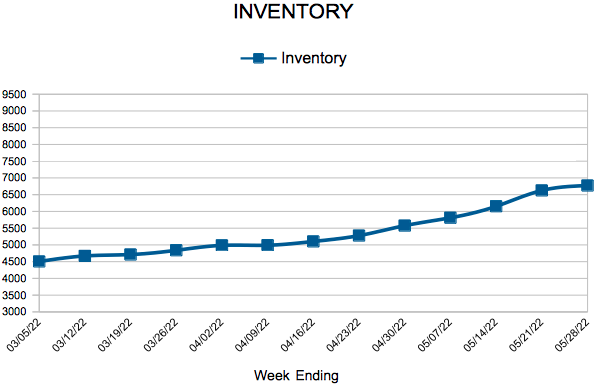

- Inventory increased 9.8% to 8,209

FOR THE MONTH OF MAY:

- Median Sales Price increased 9.0% to $375,000

- Days on Market decreased 4.2% to 23

- Percent of Original List Price Received increased 0.1% to 104.1

- Months Supply of Homes For Sale increased 27.3% to 1.4

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.