April 13, 2023

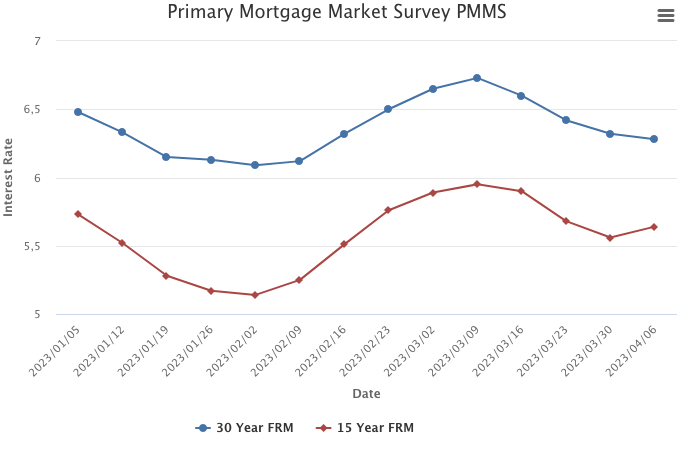

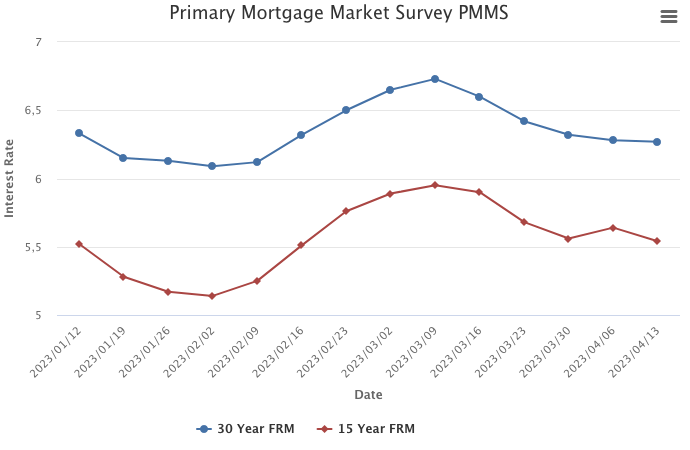

Mortgage rates decreased for the fifth consecutive week. Incoming data suggest inflation remains well above the desired level but showing signs of deceleration. These trends, coupled with tight labor markets, are creating increased optimism among prospective homebuyers as the housing market hits its peak in the spring and summer.

Information provided by Freddie Mac.

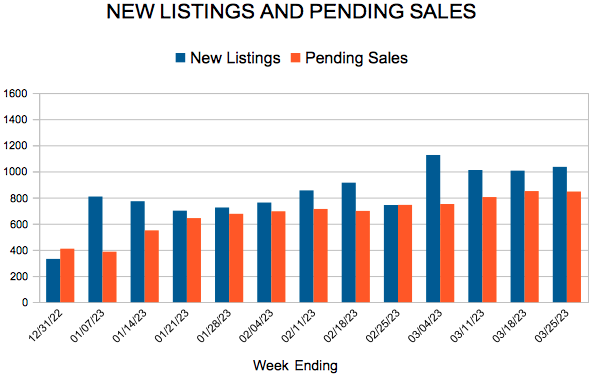

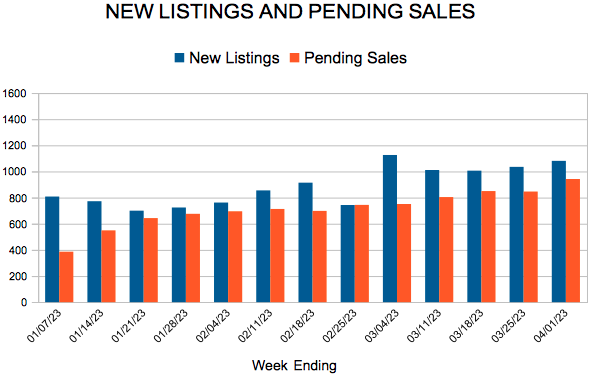

For Week Ending April 1, 2023

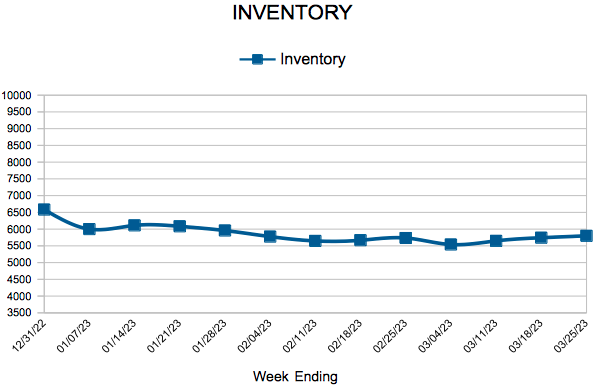

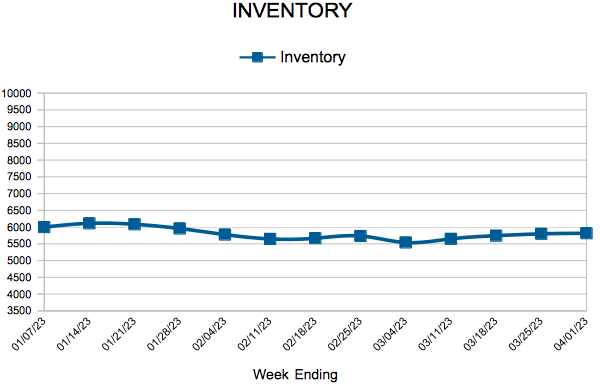

For Week Ending April 1, 2023