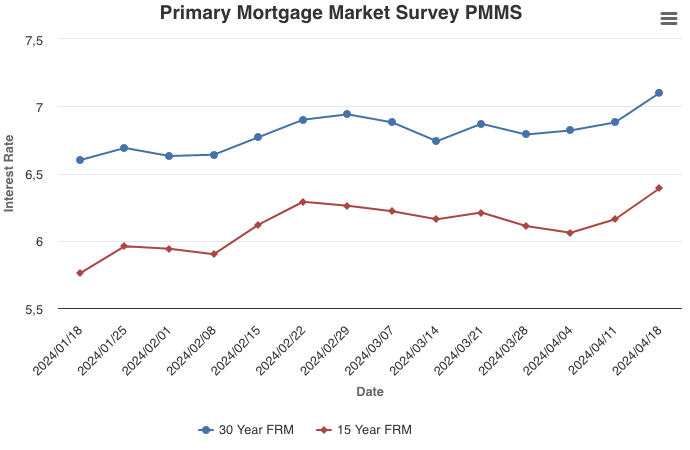

Mortgage Rates Exceed 7 Percent for the First Time this Year

April 18, 2024

The 30-year fixed-rate mortgage surpassed 7 percent for the first time this year, jumping from 6.88 percent to 7.10 percent this week. As rates trend higher, potential homebuyers are deciding whether to buy before rates rise even more or hold off in hopes of decreases later in the year. Last week, purchase applications rose modestly, but it remains unclear how many homebuyers can withstand increasing rates in the future.

Information provided by Freddie Mac.

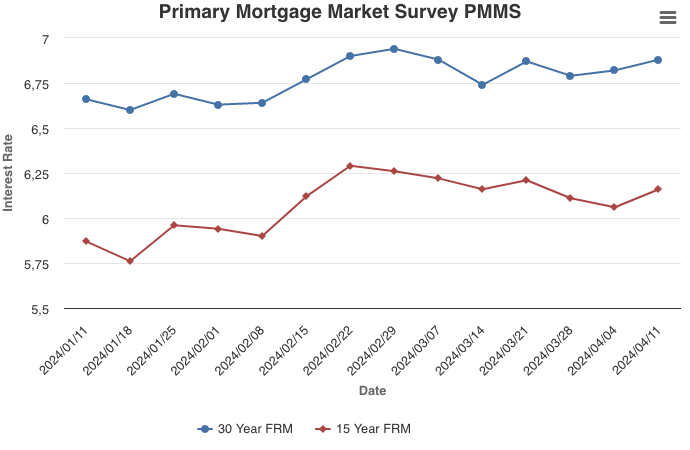

Mortgage Rates Move Toward Seven Percent as Markets Digest Incoming Data

April 11, 2024

Mortgage rates have been drifting higher for most of the year due to sustained inflation and the reevaluation of the Federal Reserve’s monetary policy path. While newly released inflation data from March continues to show a trend of very little movement, the financial market’s reaction paints a far different economic picture. Since inflation decelerated from 9% to 3% between June 2022 and June 2023, the annual growth rate of inflation has remained effectively flat, ranging from 3.1% to 3.7% and averaging 3.3%. The March estimate of 3.5% annual growth is in the middle of that range. However, the market’s reaction was dramatically different, as illustrated by a significant drop in the Dow Jones Industrial Average post-announcement.

It’s clear that while the trend in inflation data has been close to flat for nearly a year, the narrative is much less clear and resembles the unrealized expectations of a recession from a year ago.

Information provided by Freddie Mac.

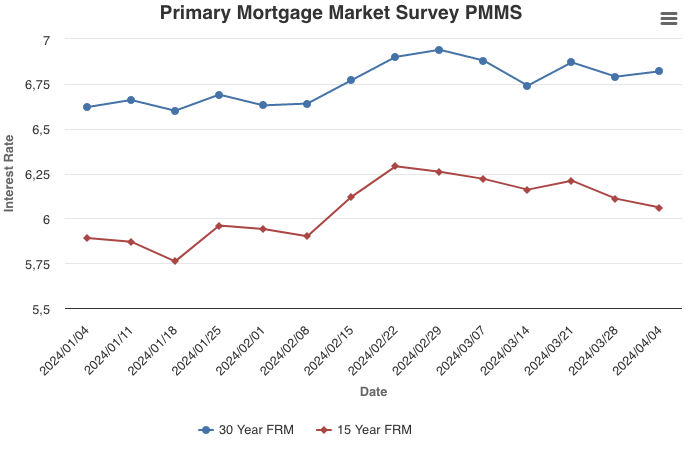

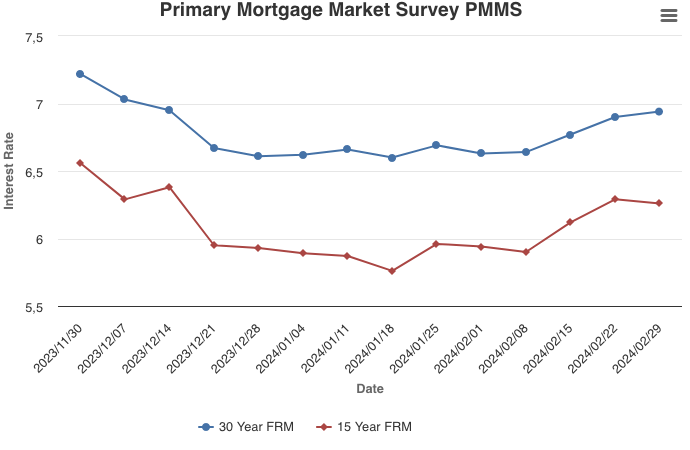

Mortgage Rates Continue to Show Little Movement

April 4, 2024

Mortgage rates showed little movement again this week, hovering around 6.8 percent. Since the start of 2024, the 30-year fixed-rate mortgage has not reached seven percent but has not dropped below 6.6 percent either. While incoming economic signals indicate lower rates of inflation, we do not expect rates will decrease meaningfully in the near-term. On the plus side, inventory is improving somewhat, which should help temper home price growth.

Information provided by Freddie Mac.

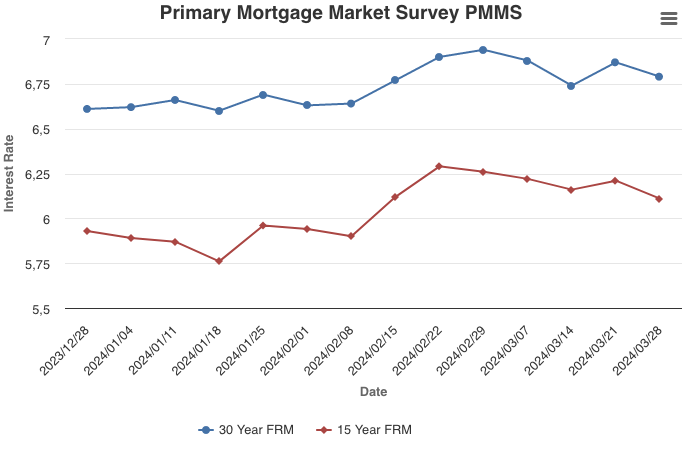

Mortgage Rates Drop Slightly

March 28, 2024

Mortgage rates moved slightly lower this week, providing a bit more room in the budgets of some prospective homebuyers. Additionally, encouraging data out on existing home sales reflects improving inventory. Regardless, rates remain elevated near seven percent as markets watch for signs of cooling inflation, hoping that rates will come down further.

Information provided by Freddie Mac.

February Monthly Skinny Video

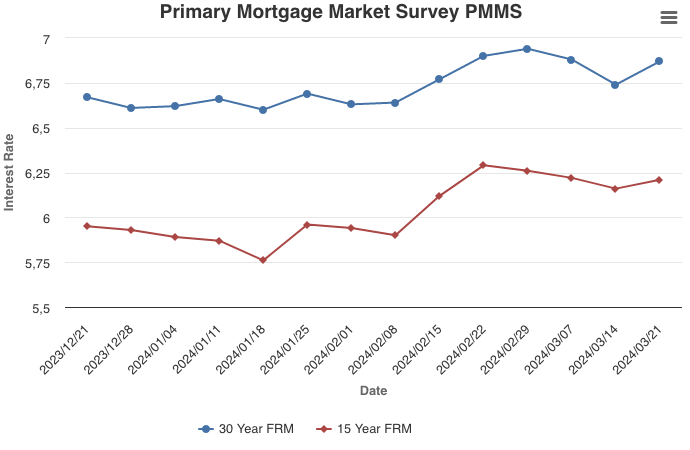

Mortgage Rates Increase, Nearing Seven Percent

March 21, 2024

After decreasing for a couple of weeks, mortgage rates are once again on the upswing. As the spring homebuying season gets underway, existing home inventory has increased slightly and new home construction has picked up. Despite elevated rates, homebuilders are displaying renewed confidence in the housing market, focusing on the fact that there is a good amount of pent-up demand, an ongoing supply shortage and expectations that the Federal Reserve will cut rates later in the year.

Information provided by Freddie Mac.

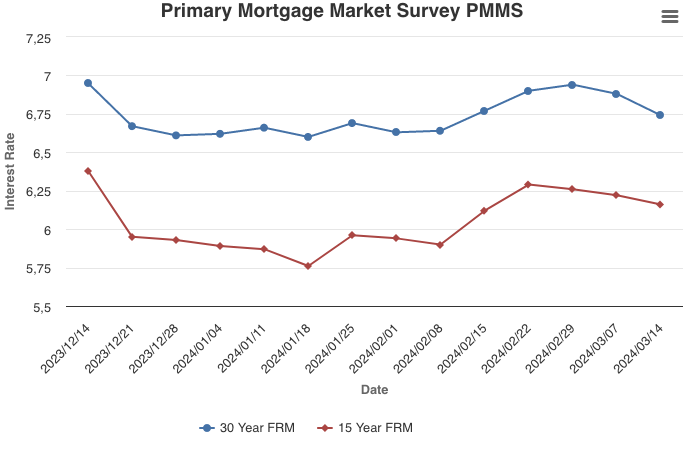

Mortgage Rates Continue to Decrease

March 14, 2024

The 30-year fixed-rate mortgage decreased again this week, with declines totaling almost a quarter of a percent in two weeks’ time. Despite the recent dip, mortgage rates remain high as the market contends with the pressure of sticky inflation. In this environment, there is a good possibility that rates will stay higher for a longer period of time.

Information provided by Freddie Mac.

Mortgage Rates Dip Down

March 7, 2024

Evidence that purchase demand remains sensitive to interest rate changes was on display this week, as applications rose for the first time in six weeks in response to lower rates. Mortgage rates continue to be one of the biggest hurdles for potential homebuyers looking to enter the market. It’s important to remember that rates can vary widely between mortgage lenders so shopping around is essential.

Information provided by Freddie Mac.

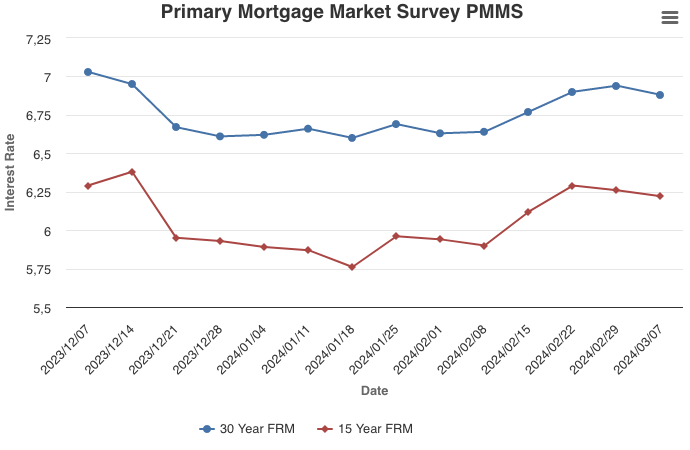

Mortgage Rates Increase for the Fourth Consecutive Week

February 29, 2024

Mortgage rates continued their ascent this week, reaching a two-month high and flirting with seven percent yet again. The recent boomerang in rates has dampened already tentative homebuyer momentum approaching the spring, a historically busy season for homebuying. While sales of newly built homes are trending in a positive direction, higher rates and elevated prices continue to pose affordability challenges that may leave potential homebuyers on the sidelines.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 23

- Next Page »