For Week Ending June 8, 2024

For Week Ending June 8, 2024

U.S. home prices have increased by more than 47% since 2020, according to a recent analysis by ResiClub of the Case-Shiller National Home Price Index, outpacing the growth of the 1990s and 2010s, which saw prices rise 30.1% and 44.7%, respectively. Analysts say home price growth this decade is on track to surpass the growth of the 2000s, when home prices rose 47.3%.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 8:

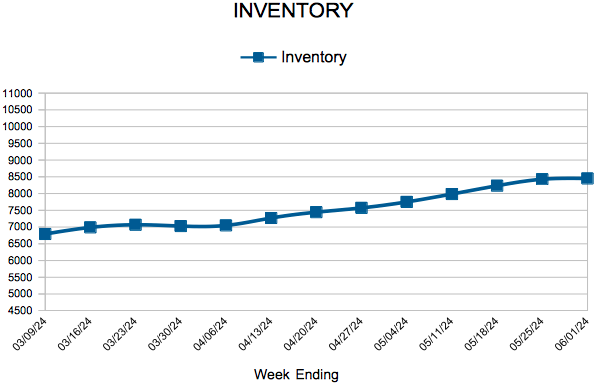

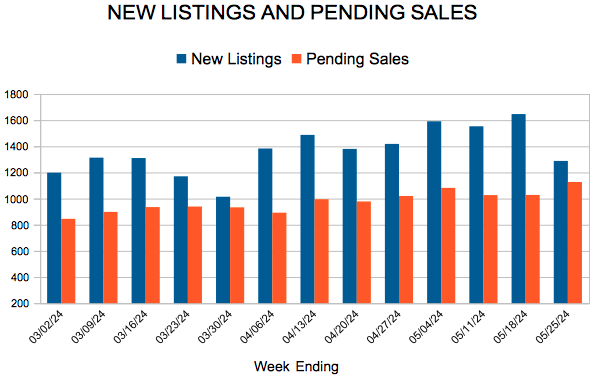

- New Listings increased 3.2% to 1,666

- Pending Sales decreased 7.1% to 1,068

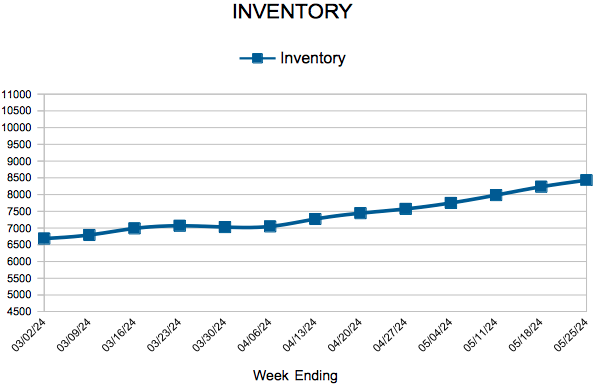

- Inventory increased 12.9% to 8,613

FOR THE MONTH OF MAY:

- Median Sales Price increased 4.1% to $385,000

- Days on Market increased 5.3% to 40

- Percent of Original List Price Received decreased 1.0% to 100.1%

- Months Supply of Homes For Sale increased 21.1% to 2.3

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.