For Week Ending February 5, 2022

For Week Ending February 5, 2022

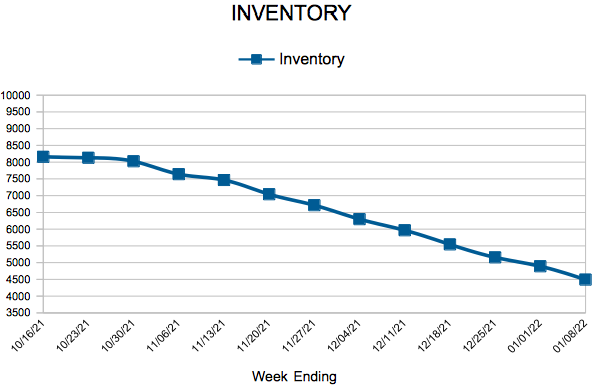

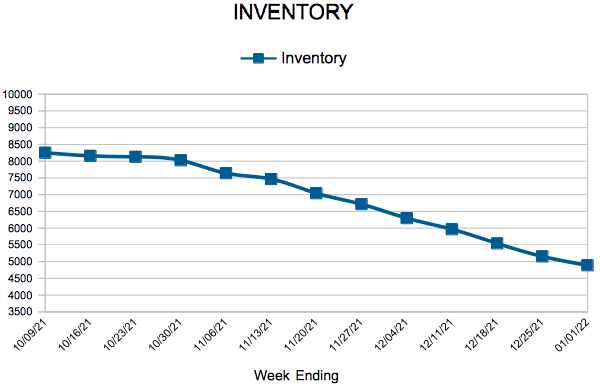

Despite falling temperatures and a surge in COVID-19 cases across the country, the U.S. real estate market remains active, with homes selling in record time due to robust buyer demand and a shortage of housing options. With inventory down 28.4% compared to a year ago, the average home spent just 61 days on the market in January, a 14% drop from last year and the fastest pace of any January on record, according to Realtor.com’s monthly housing report.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 5:

- New Listings decreased 15.3% to 1,018

- Pending Sales decreased 19.1% to 883

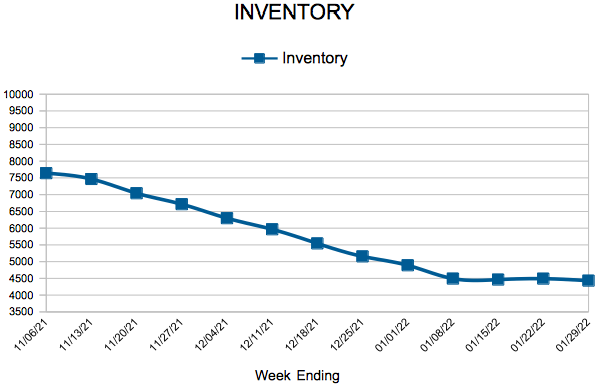

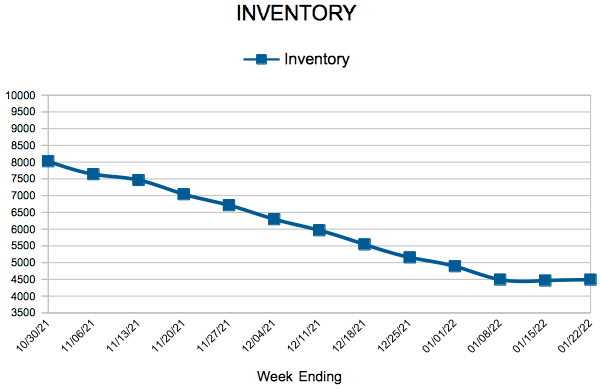

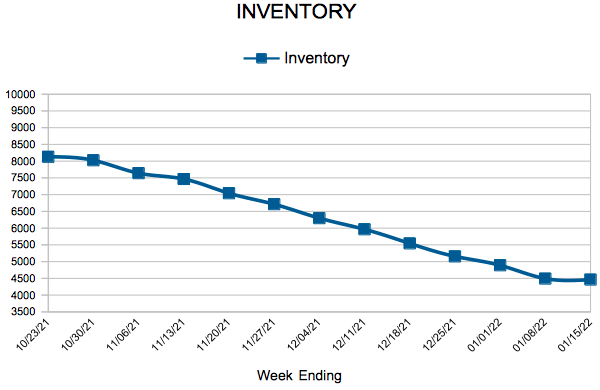

- Inventory decreased 21.2% to 4,341

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 8.0% to $331,420

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 18.2% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.