For Week Ending June 25, 2022

For Week Ending June 25, 2022

Skyrocketing rents and surging homeownership costs are forcing many prospective buyers to remain in the rental market. With the national median existing-home price recently exceeding $400,000, and assuming a down payment of 3.5%, buyers would need to come up with $14,000 down toward the typical median-priced home. That’s a significant challenge for millions of renters, whom have a median savings of $1,500 or less, according to Harvard researchers’ State of the Nation’s Housing 2022 report.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 25:

- New Listings decreased 4.5% to 1,825

- Pending Sales decreased 25.0% to 1,221

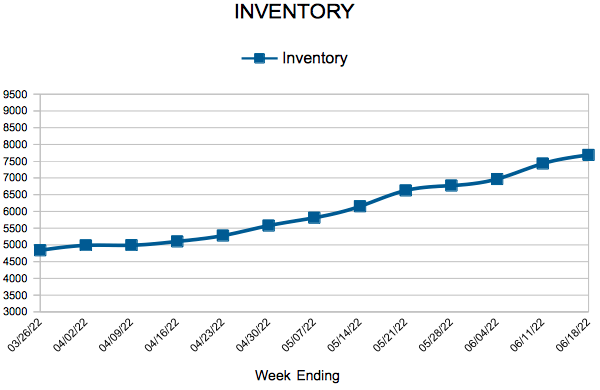

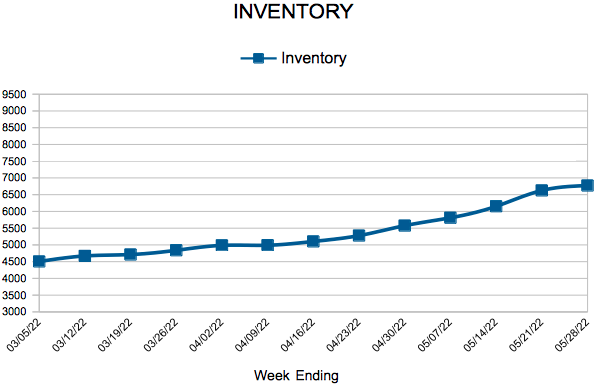

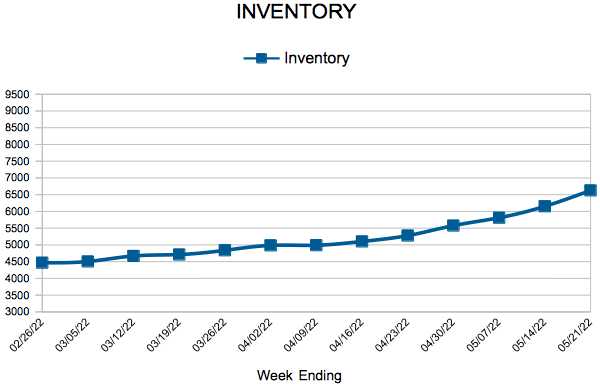

- Inventory increased 6.8% to 7,974

FOR THE MONTH OF MAY:

- Median Sales Price increased 9.0% to $375,000

- Days on Market decreased 4.2% to 23

- Percent of Original List Price Received increased 0.1% to 104.1%

- Months Supply of Homes For Sale increased 27.3% to 1.4

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.