September 11, 2025

The 30-year fixed-rate mortgage fell 15 basis points from last week, the largest weekly drop in the past year. Mortgage rates are headed in the right direction and homebuyers have noticed, as purchase applications reached the highest year-over-year growth rate in more than four years.

Information provided by Freddie Mac.

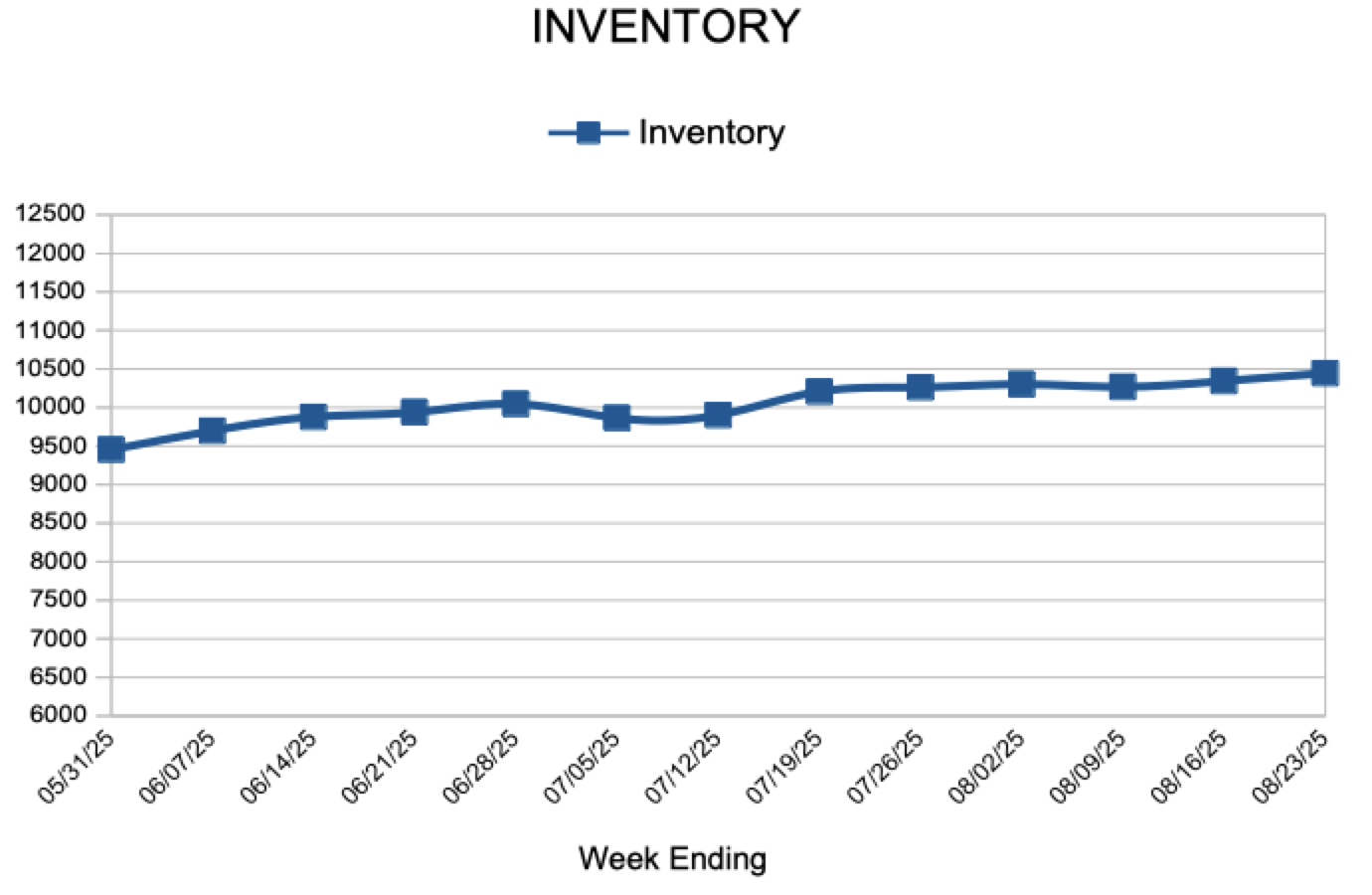

For Week Ending August 30, 2025

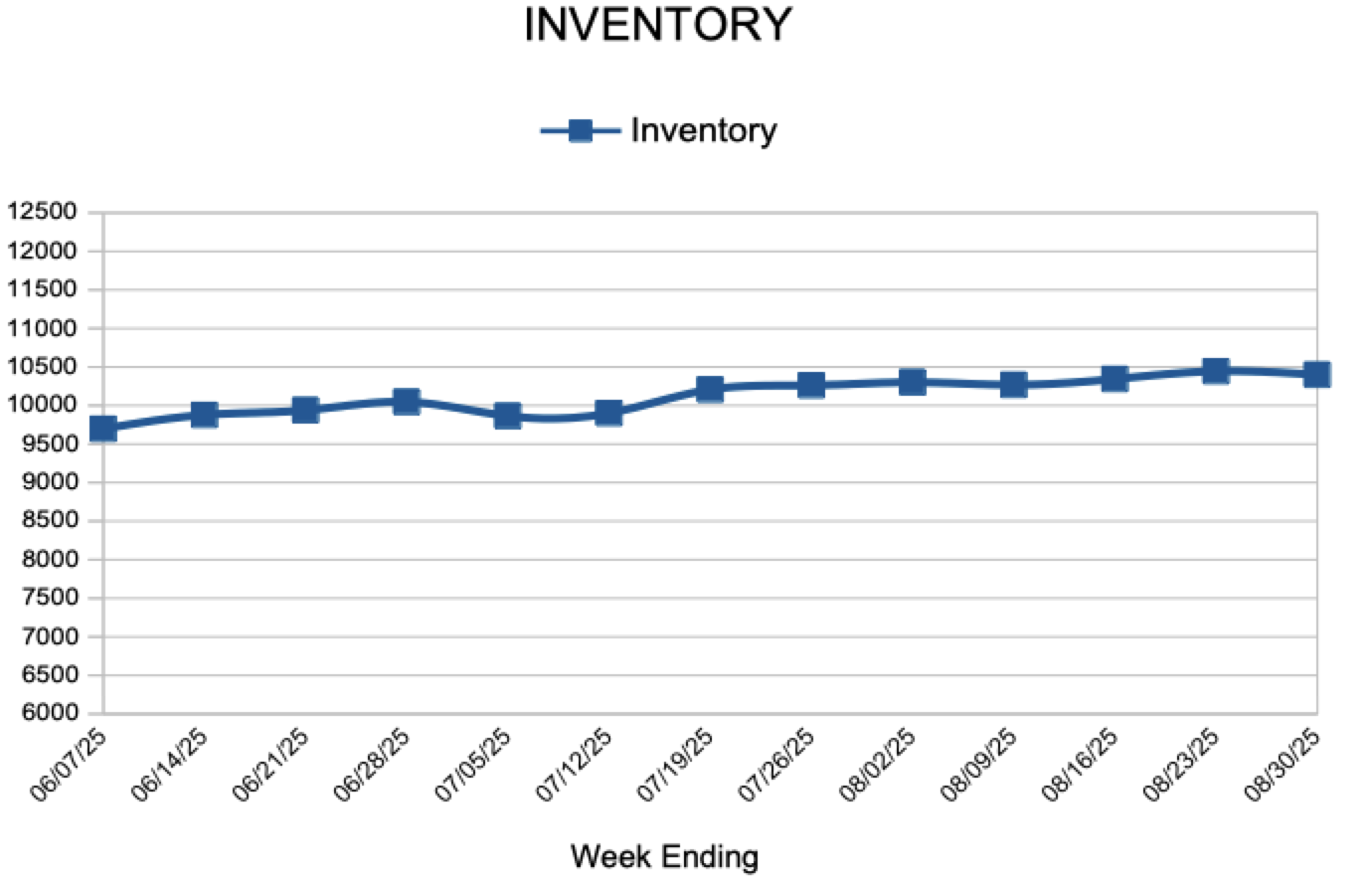

For Week Ending August 30, 2025