August 28, 2025

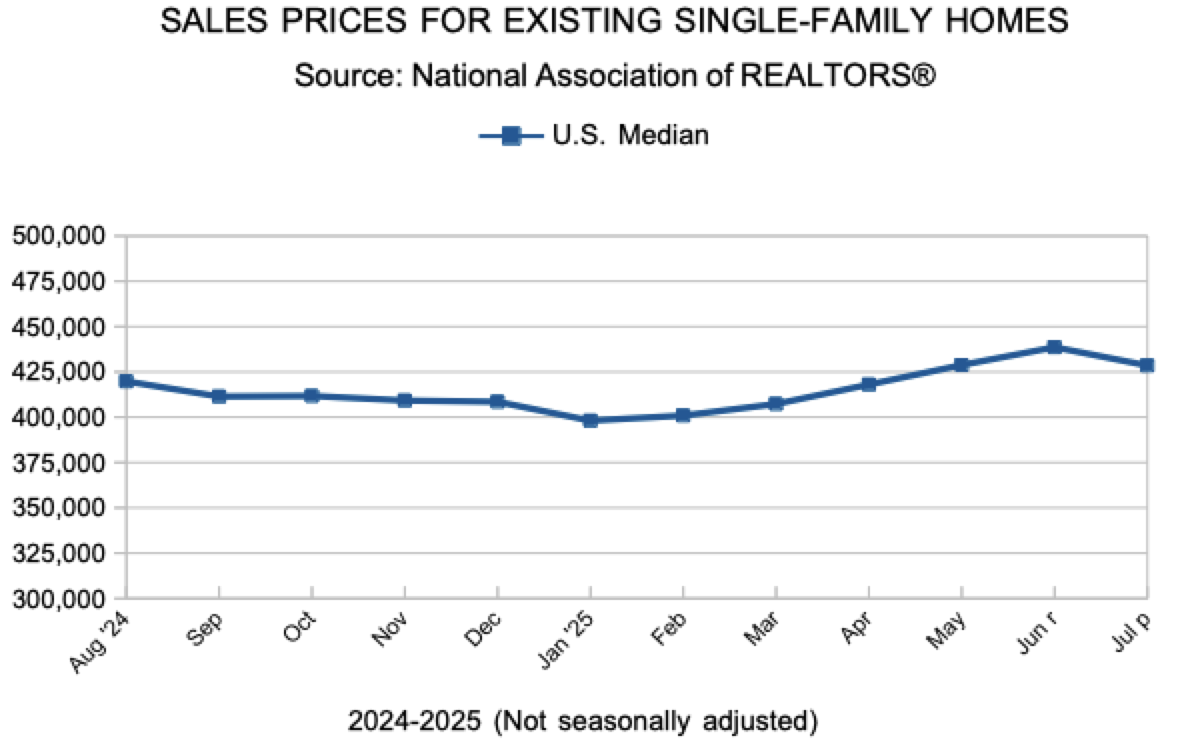

Mortgage rates are at a 10-month low. Purchase demand continues to rise on the back of lower rates and solid economic growth. Though many potential homebuyers still face affordability challenges, consistently lower rates may provide them with the impetus to enter the market.

Information provided by Freddie Mac.

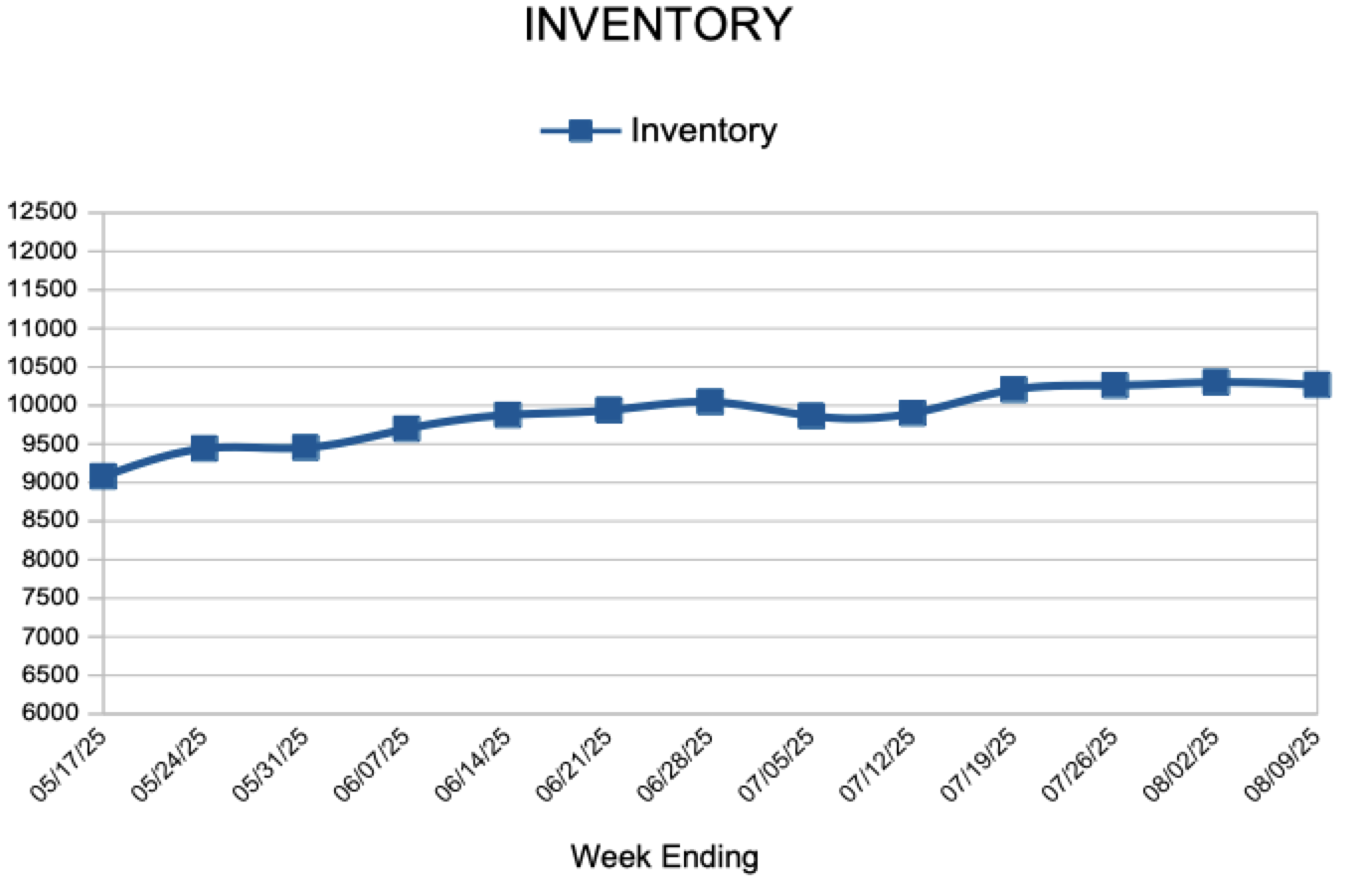

For Week Ending August 16, 2025

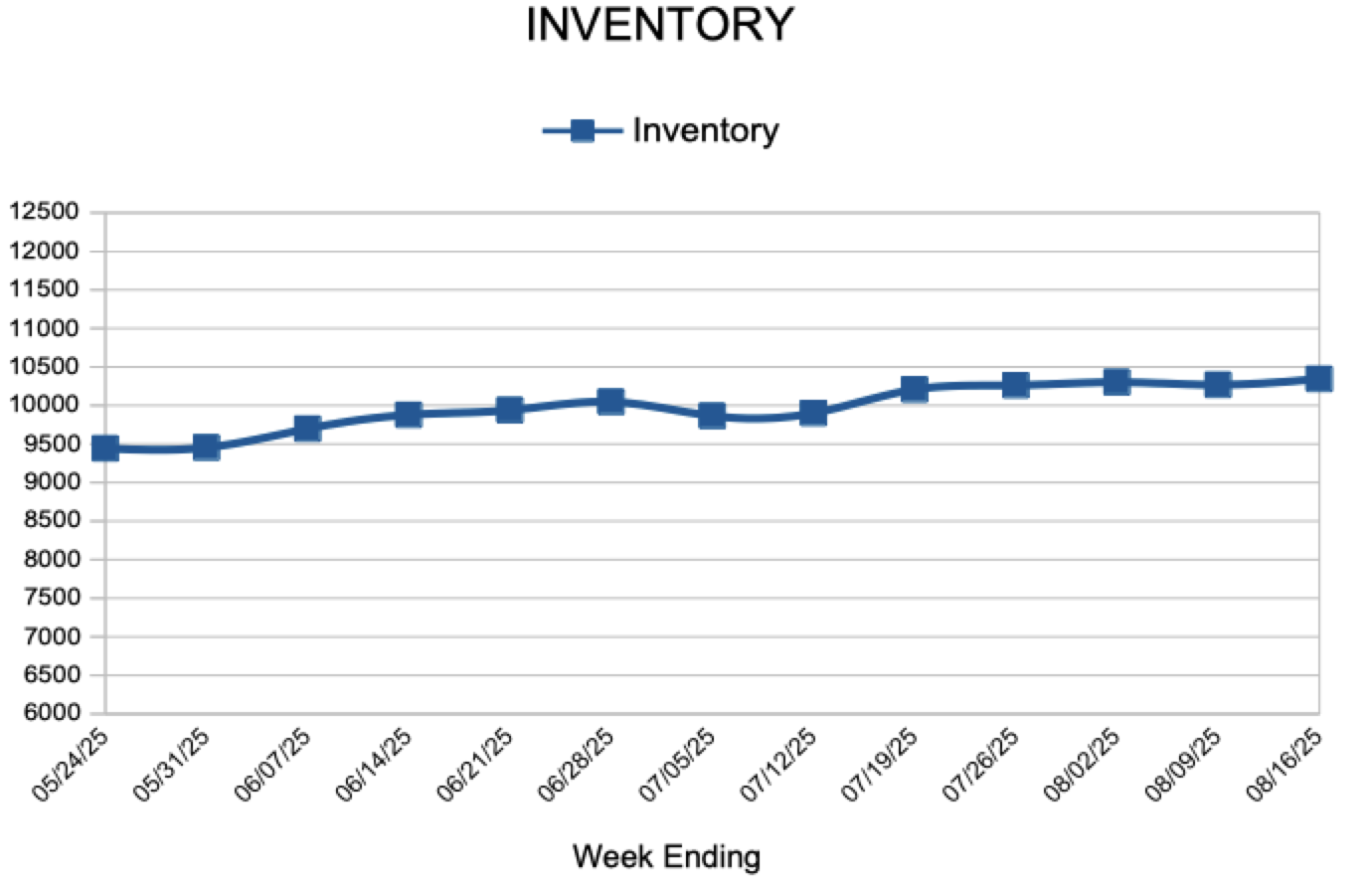

For Week Ending August 16, 2025