May 30, 2024

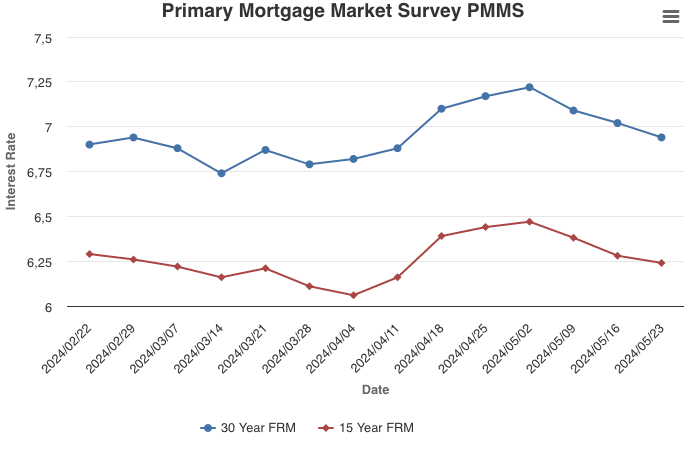

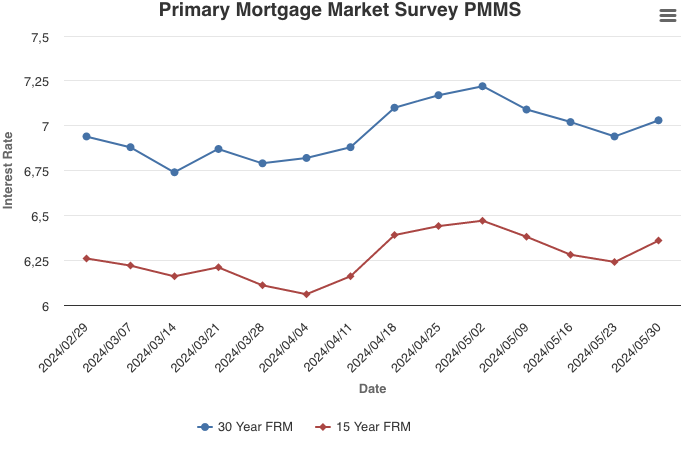

Following several weeks of decline, mortgage rates changed course this week. More hawkish commentary about inflation and tepid demand for longer-dated Treasury auctions caused market yields to rise across the board. This reality, as well as economic signals that have moved sideways over the last few weeks, have resulted in mortgage rates drifting higher as markets continue to dial back expectations of interest rate cuts.

Information provided by Freddie Mac.

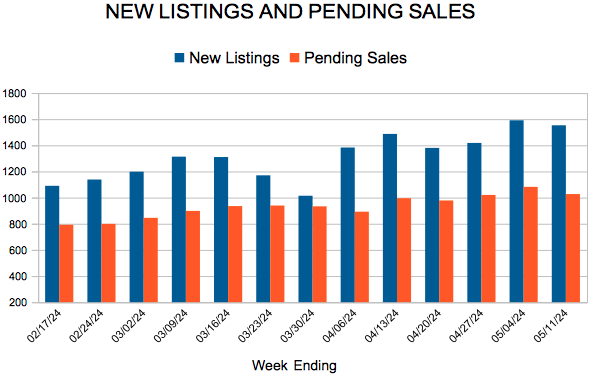

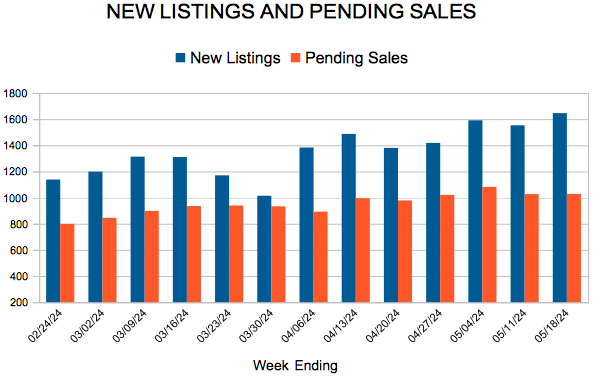

For Week Ending May 18, 2024

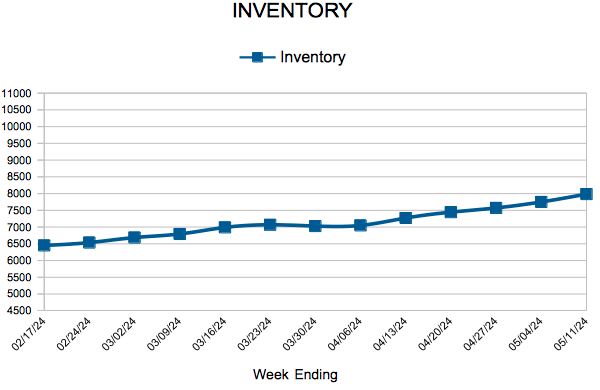

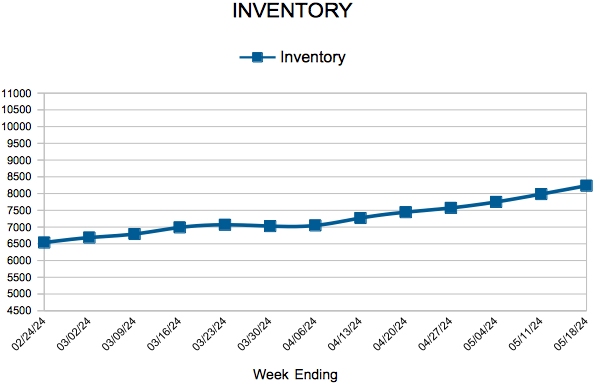

For Week Ending May 18, 2024