Archives for January 2024

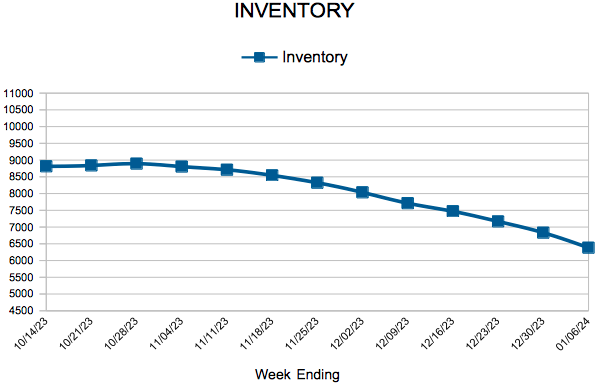

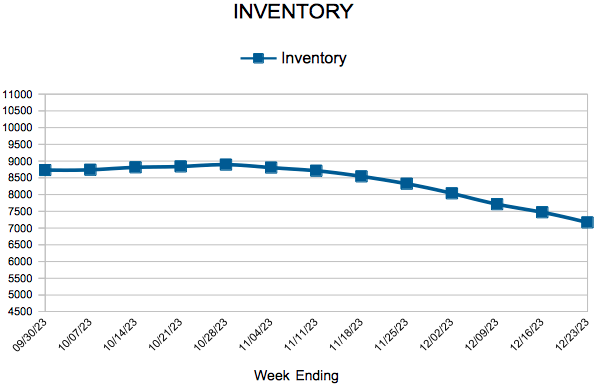

Inventory

Weekly Market Report

For Week Ending January 6, 2024

For Week Ending January 6, 2024

Median priced single-family homes and condos were less affordable compared to historical averages in 99% of counties nationwide in the 4th quarter of 2023, according to ATTOM’s Q4 2023 U.S. Home Affordability Report. Major homeownership expenses currently take up 33.7% of the average national wage, a slight improvement from the third quarter, when major expenses consumed 35% of the average national wage. ATTOM reports homeowners need an annual income of more than $75,000 to afford a home in approximately 57% of the county markets in the report.

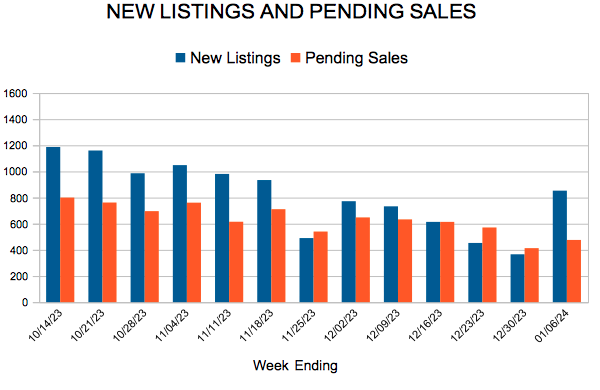

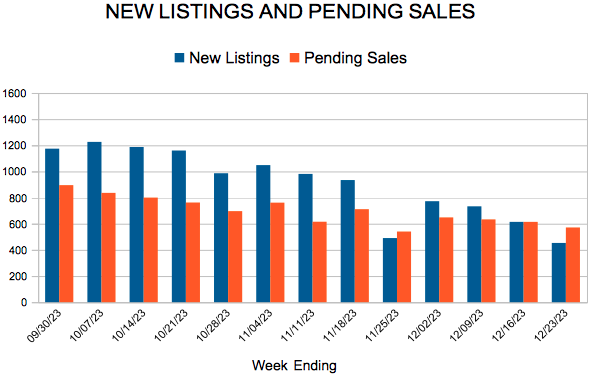

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 6:

- New Listings increased 3.9% to 853

- Pending Sales increased 19.3% to 476

- Inventory decreased 2.7% to 6,382

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,550

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

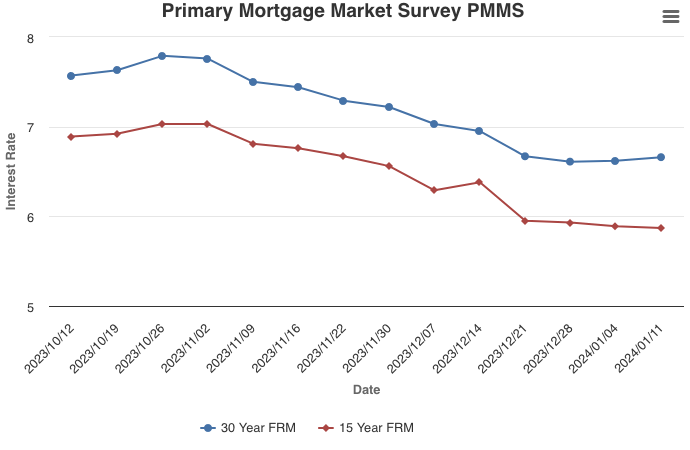

Mortgage Rates Continue to Hover in the Mid-Six Percent Range

January 11, 2024

Mortgage rates have not moved materially over the last three weeks and remain in the mid-six percent range, which has marginally increased homebuyer demand. Even this slight uptick in demand, combined with inventory that remains tight, continues to cause prices to rise faster than incomes, meaning affordability remains a major headwind for buyers. Potential homebuyers should look closely at existing state and local resources, such as down payment assistance programs, which can considerably help defray closing costs.

Information provided by Freddie Mac.

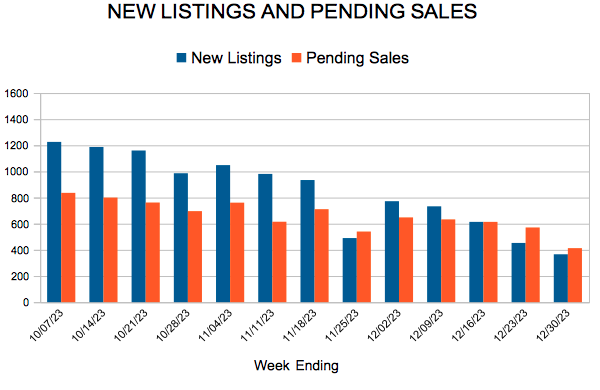

New Listings and Pending Sales

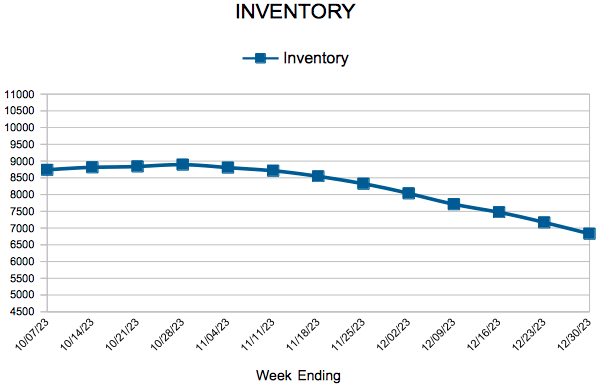

Inventory

Weekly Market Report

For Week Ending December 30, 2023

For Week Ending December 30, 2023

U.S housing starts surged following the drop in mortgage rates, jumping 14.8% from the previous month to a seasonally adjusted annual rate of 1,560,000 units, according to the U.S. Census Bureau. The latest reading was boosted by an increase in single-family starts, which climbed 18% from the previous month. Housing completions were also up, rising 5% month-over-month. The average 30-year fixed-rate mortgage has fallen more than one percentage point since its peak in late October, leading to an increase in building activity and builder sentiment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 30:

- New Listings increased 6.7% to 366

- Pending Sales increased 1.2% to 413

- Inventory decreased 5.3% to 6,831

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,550

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

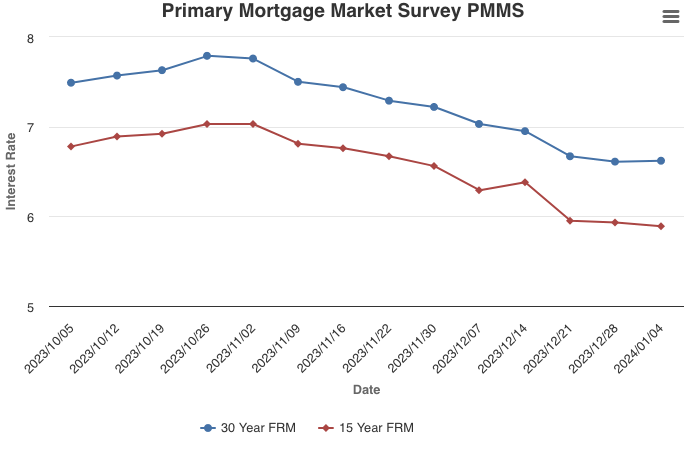

Mortgage Rates Move Sideways as Markets Digest Incoming Data

January 4, 2024

Between late October and mid-December, the 30-year fixed-rate mortgage plummeted more than a percentage point. However, since then rates have moved sideways as the market digests incoming economic data. Given the expectation of rate cuts this year from the Federal Reserve, as well as receding inflationary pressures, mortgage rates will likely continue to drift downward as the year unfolds. While lower mortgage rates are welcome news, potential homebuyers are still dealing with the dual challenges of low inventory and high home prices that continue to rise.

Information provided by Freddie Mac.