August 17, 2023

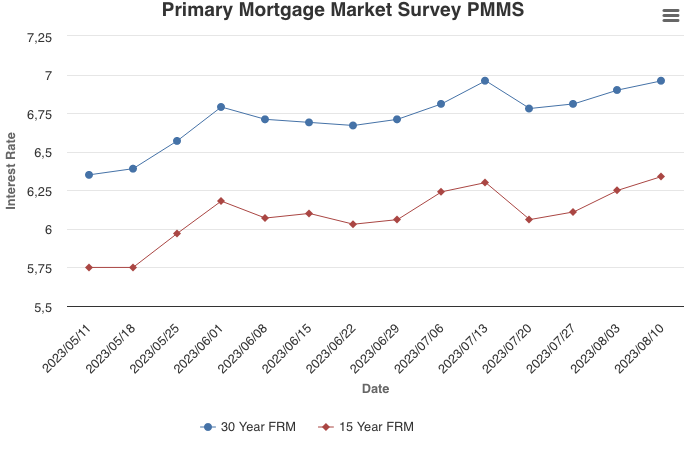

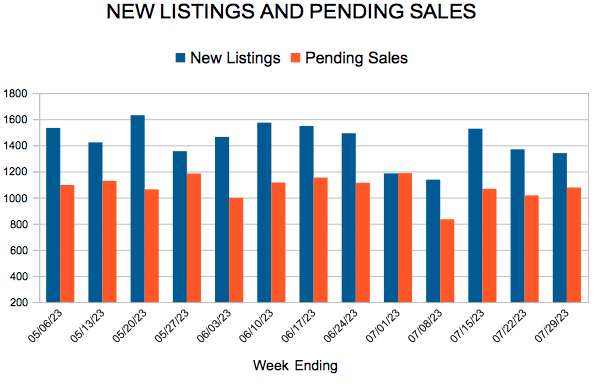

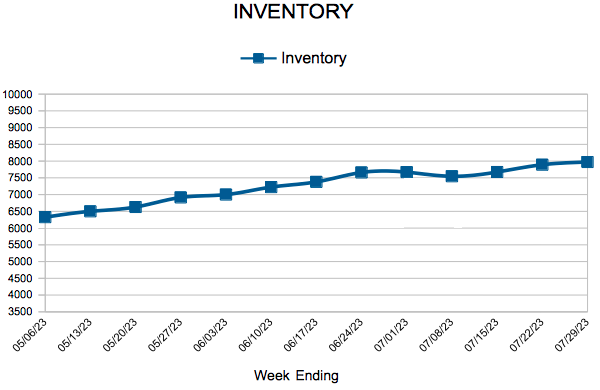

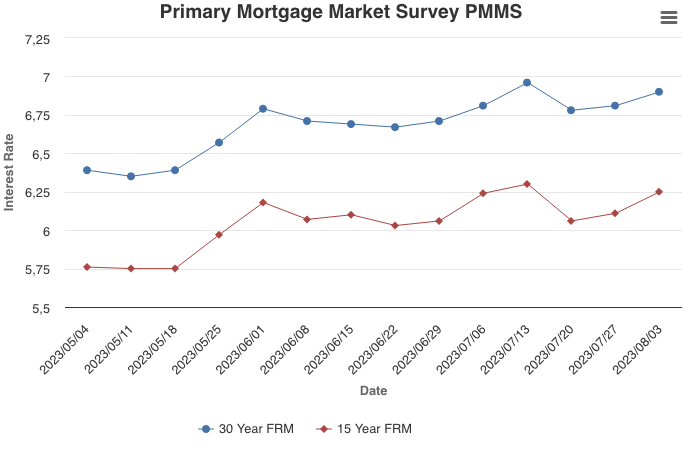

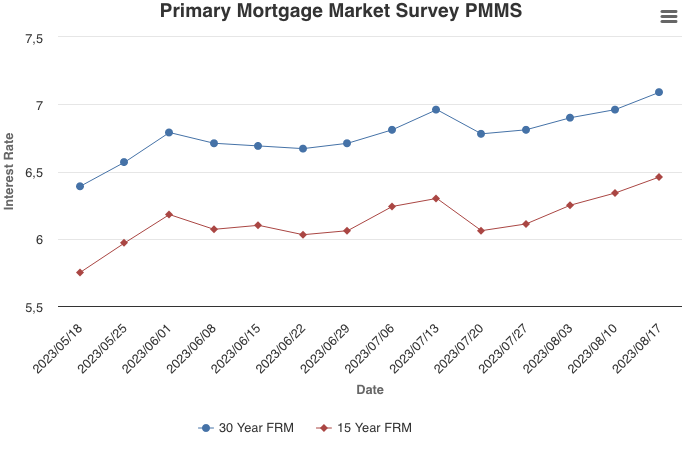

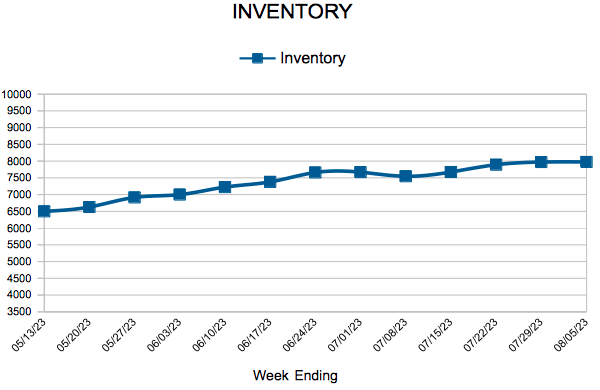

The economy continues to do better than expected and the 10-year Treasury yield has moved up, causing mortgage rates to climb. The last time the 30-year fixed-rate mortgage exceeded seven percent was last November. Demand has been impacted by affordability headwinds, but low inventory remains the root cause of stalling home sales.

Information provided by Freddie Mac.

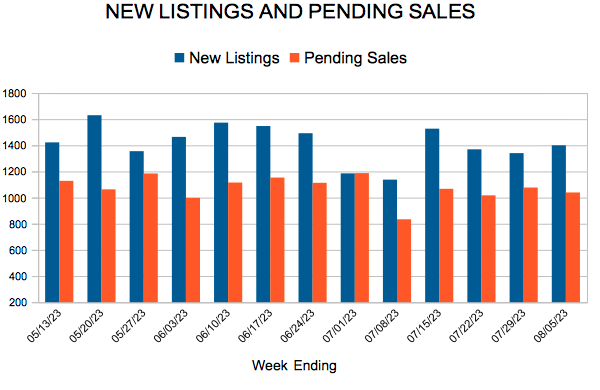

For Week Ending August 5, 2023

For Week Ending August 5, 2023