Weekly Market Report

For Week Ending March 26, 2022

For Week Ending March 26, 2022

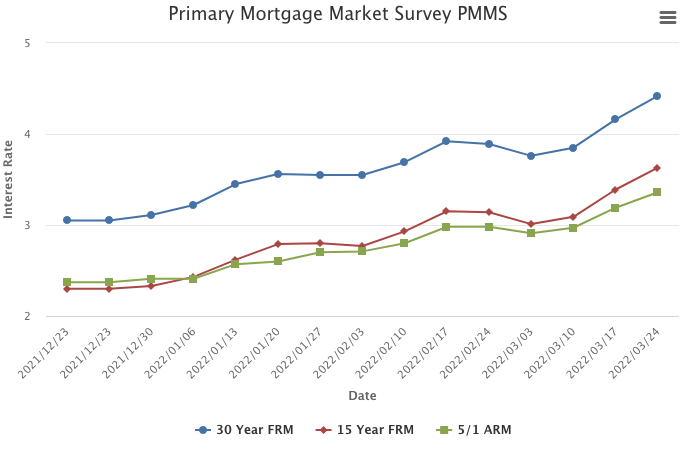

Mortgage rates have surged recently, jumping to 4.42% the week ending March 24, up more than a quarter of a percentage point compared to the previous week, Freddie Mac reports. Rates have increased 1.2% since January and are at the highest level in more than 3 years, with the typical homebuyer now spending $250 more per month to purchase a home, according to the National Association of REALTORS®.

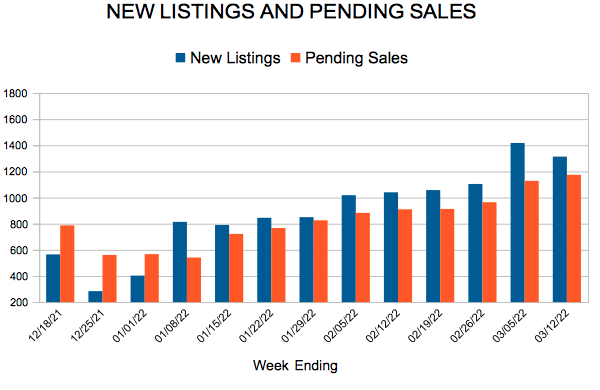

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 26:

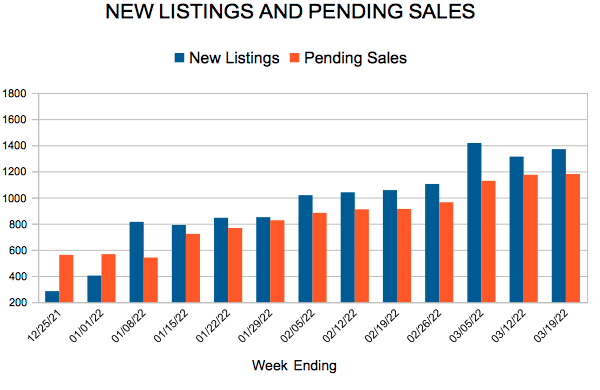

- New Listings decreased 12.8% to 1,366

- Pending Sales decreased 12.8% to 1,178

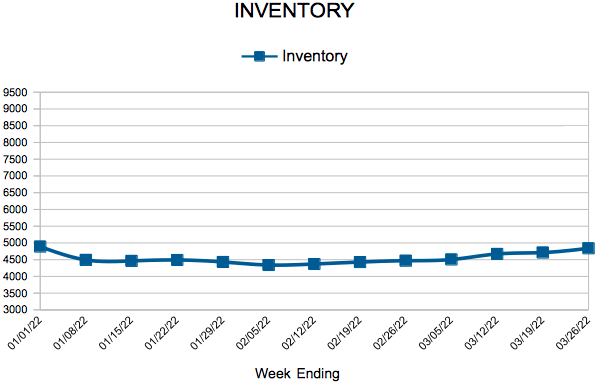

- Inventory decreased 13.7% to 4,839

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 8.3% to $340,000

- Days on Market decreased 4.3% to 44

- Percent of Original List Price Received increased 0.7% to 100.8%

- Months Supply of Homes For Sale decreased 10.0% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

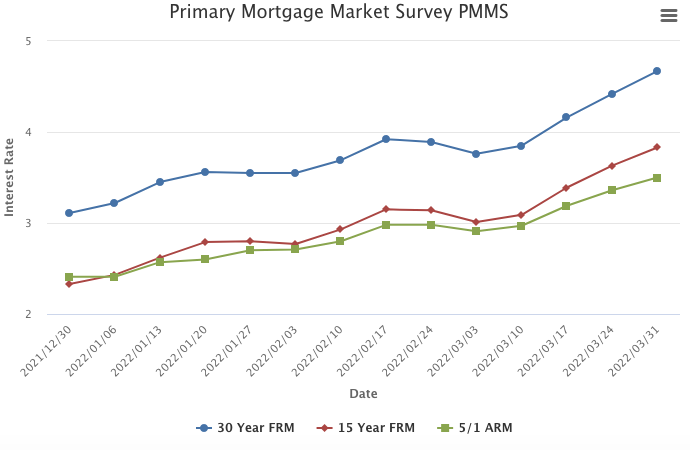

Mortgage Rates Exceed Four and a Half Percent

March 31, 2022

Mortgage rates continued moving upward in the face of rapidly rising inflation as well as the prospect of strong demand for goods and ongoing supply disruptions. Purchase demand has weakened modestly but has continued to outpace expectations. This is largely due to unmet demand from first-time homebuyers as well as a select few who had been waiting for rates to hit a cyclical low.

Information provided by Freddie Mac.

February Monthly Skinny Video

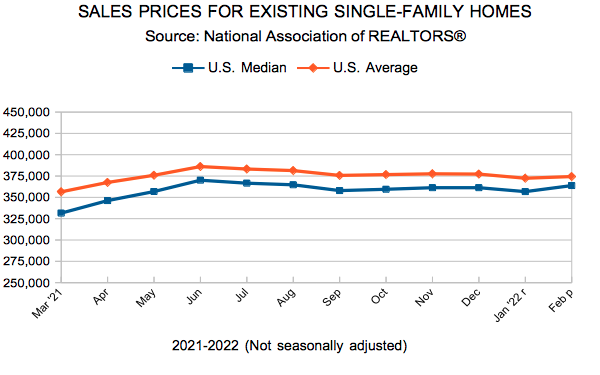

The U.S. real estate market remains hot ahead of the spring selling season, with existing home sales up 6.7% as of last measure. Experts attribute the growth in sales to an uptick in mortgage interest rates, as buyers rushed to lock down their home purchases before rates move higher. Even so, sales prices continue to rise with a Median Sales Price increase of 8.3 percent to $340,000 from this time last year.

New Listings and Pending Sales

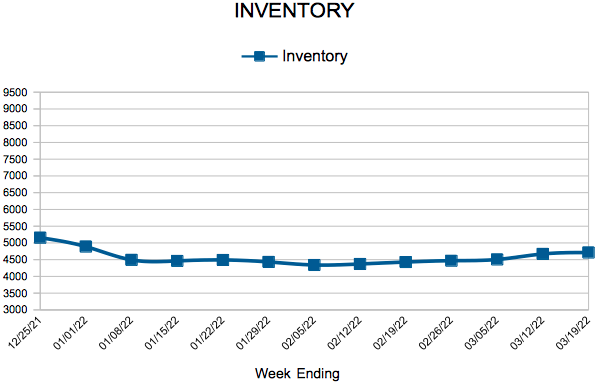

Inventory

Weekly Market Report

For Week Ending March 19, 2022

For Week Ending March 19, 2022

Rising sales prices and a surge in mortgage rates haven’t been enough to cool demand and ease competition heading into the spring market. Agents are reporting homes are selling at lightning speed and often with multiple offers. According to the National Association of REALTORS®, 84% listings were on the market less than 30 days last month, with an average of 5 offers on each home sold, and 48% of offers above list price nationwide.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 19:

- New Listings decreased 6.8% to 1,370

- Pending Sales decreased 6.6% to 1,180

- Inventory decreased 14.6% to 4,713

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 8.3% to $340,000

- Days on Market decreased 4.3% to 44

- Percent of Original List Price Received increased 0.7% to 100.8%

- Months Supply of Homes For Sale decreased 10.0% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Move Up

March 24, 2022

This week, the 30-year fixed-rate mortgage increased by more than a quarter of a percent as mortgage rates across all loan types continued to move up. Rising inflation, escalating geopolitical uncertainty and the Federal Reserve’s actions are driving rates higher and weakening consumers’ purchasing power. In short, the rise in mortgage rates, combined with continued house price appreciation, is increasing monthly mortgage payments and quickly affecting homebuyers’ ability to keep up with the market.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pendings

- « Previous Page

- 1

- …

- 82

- 83

- 84

- 85

- 86

- …

- 107

- Next Page »