For Week Ending January 25, 2025

For Week Ending January 25, 2025

U.S. housing starts jumped 15.8% month-over-month to a seasonally adjusted annual rate of 1,499,000 units, but were down 4.4% from one year ago, according to the U.S. Census Bureau. Single-family starts climbed 3.3% month-over-month to a seasonally adjusted annual rate of 1,050,000 units, while multi-family starts surged 58.9% to a seasonally adjusted annual rate of 418,000 units.

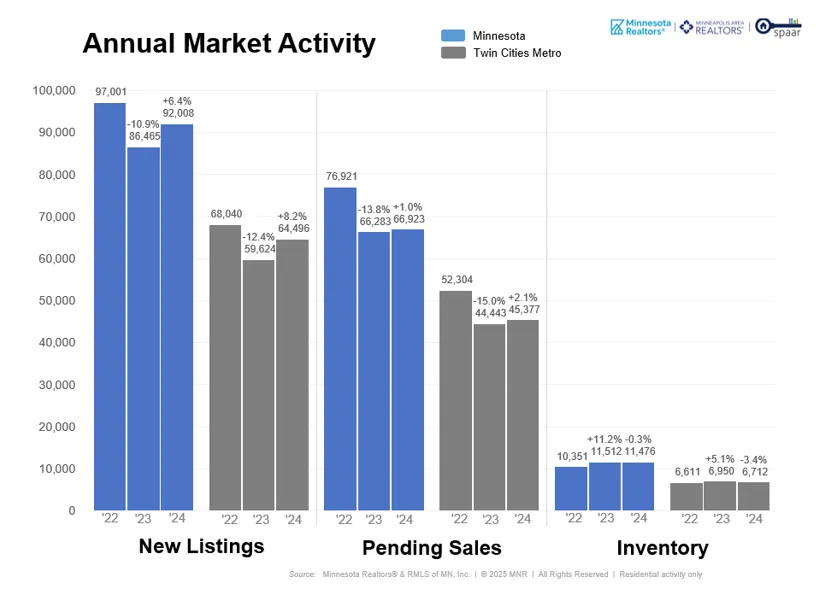

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 25:

- New Listings increased 2.2% to 886

- Pending Sales decreased 15.2% to 610

- Inventory decreased 2.3% to 6,888

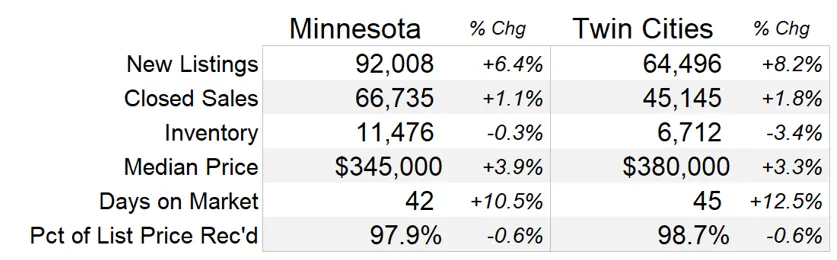

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 4.6% to $370,000

- Days on Market increased 9.8% to 56

- Percent of Original List Price Received increased 0.3% to 97.0%

- Months Supply of Homes For Sale remained flat at 1.9

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.